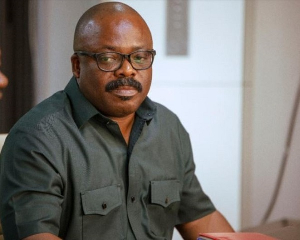

Finance Minister, Ken Ofori-Atta has lauded the Ghana Revenue Authority's move to embark on a 'National Tax Campaign' to create more awareness of the benefit of paying tax and to improve voluntary compliance so as to increase revenue for development.

Ken Ofori-Atta said the move will ensure that more people in the non-formal sector of the economy, are included in the taxpaying net.

He indicated that the current the revenue generated from the taxpaying population was inadequate to support adequately the needs of the citizens.

"We have lest say 10 million people who are economically active. We have 1.1 million people actually paying sought of formal and doing the payee thing. So through that, we pick up maybe 3 billion Ghana cedes at the end of the year. that means we have 8 million people unaccounted for. So imagine as Mr Stephen Oppong said if we all render to Caesar what was Caesar's, this whole issue of our capacity to support the necessary public good which is education, health, security will not something to talk to DFID or GIZ about but things that we can personally fund." he remarked.

Finance Minister disclosed that despite the challenges with revenue mobilisation and the inadequate revenue generated by the small taxpaying population, the government has expressed its commitment to utilising the little resource into human capital development.

"Really for us in government, we have to make choices and we decided that the human capital of our society is one of the most important things and therefore we programmed resources into lest say Free SHS. What does that mean? if we then do that certainly other areas will be challenged but we cannot compromise the future of our society with illiteracy. We just can't." He stated

"I am sure if I am to take a survey around here and ask how many people have filed our taxes a lot of us will be found wanting but we do get on platforms and talk about what government is not doing and what customs is not doing" he added

Ken Ofori-Atta also noted that it was unacceptable to spend close to 40% of revenue generated from taxes on paying salaries and wages of 650, 000 people.

The Minister expressed satisfaction that the GRA has taken up the challenge to improve the tax compliance and by extension, the revenue generated.

He said "I think we really need to drum home our responsibility as citizens and what we have to do and typically once you do your part of it you are able to then on a very high moral level that we in government also do our part of it"

He was speaking at the launch of GRA's 'National Tax Campaign' dubbed #Our TaxesOurFuture at the La Palm Royal Beach Hotel, Accra on Wednesday.

The campaign is to the carried out in all parts of the country with the help of the NCCE and is expected to run for four months.

Business News of Wednesday, 1 November 2017

Source: www.ghanaweb.com

Government using taxes judiciously for the benefit of all Ghanaians - Finance Minister

Entertainment