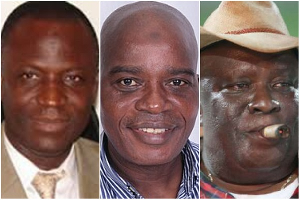

Economist Lord Mensah has hit hard at the government for introducing new taxes at a time when Ghanaian businesses are struggling.

According to him, the timing for introducing new taxes is very bad and he believes it could be beneficial for the country if it is reconsidered.

Dr. Mensah was of the view that it is expected that countries will take an inward approach to recover their economy after the pandemic, which has adversely affected all countries.

But in the situation of Ghana, it would be best to maintain the already existing taxes until businesses have picked up, the economist opined.

In an interview with Samuel Eshun on the Happy Morning Show, Dr. Lord Mensah expressed: “Every country that seeks to introduce new taxes must consider the timing. When you tax at a time that the country’s businesses are now picking up, it is likely that the people will not be so happy about the taxes”.

When Ghana recorded cases of COVID-19, a lot of businesses went down to the extent that some people were laid off. So, I believe that if we were to rely on the already existing taxes at this moment, it should keep us going till the economy has recovered and business has also picked up.

But at this point that we have introduced new taxes at a time when businesses are struggling and people have been laid off, it is not the best”.

In a Budget Statement presented to Parliament, Caretaker Minister for Finance, Osei Kyei-Mensah-Bonsu announced that the government is proposing new taxes to help the economy recover.

Among the taxes proposed by the Minister were the sanitation and pollution levy (SPL) Covid-19 Health Levy of 1% on VAT, Flat Rate Scheme (VFRS), and a 1% on National Health Insurance Levy (NHIL). The government has stressed that the introduction of these taxes forms part of revenue measures to help the economy recover.

Business News of Monday, 22 March 2021

Source: etvghana.com