ActionAid Ghana has called on the government to take a second look at tax incentives given to companies as they believe those incentives could be used to improve the quality of education in Ghana especially basic education.

According to ActionAid Ghana, the country is losing huge sums of money to companies through tax incentives as they believe is having a negative toll on the country’s education sector.

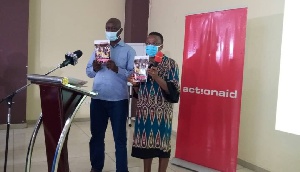

ActionAid Ghana in collaboration with the Tax Justice Coalition of Ghana made this call on government during the official launching of a report that highlights how tax incentives are depriving the government of resources needed to improve the quality of education in Ghana and also to meet the Global Partnership for Education (GPE) 20% GDP allocation to education benchmark.

Educationists in the country are lamenting what they call the over-generosity of the government’s tax incentives given to foreign investors, noting that these monies lost could provide education for over 950,000 basic school pupils.

A study by ActionAid Ghana on financing education in Ghana revealed that Ghana has lost $901.1 million as tax incentives through parliamentary tax waivers alone to corporations between 2018 and 2020 and about $657million through the GIPC investment in 2018.

The report titled ‘financing education in Ghana: how progressive taxation can increase the government’s spending on public basic schools and reverse education privatization’ was launched on Monday, November 17 in Accra.

The report noted that government expenditure allocation to the education sector is increasingly looking bleak, shifting away from the GPE target of 20%.

Speaking to Kingdom News during the launch of the report, Country Director for International Child Development Program, Joyce Larnyoh stressed that, it is high time the government takes a second look at incentives to companies either by removing it or reducing the rate of incentives that are being given to companies.

She added that these tax incentives when removed could go a long way to helping improve the country’s basic education system to help meet the global standard.

A Policy Analyst for ISODEC, Bernard Anaba speaking to Kingdom News stressed that tax incentives to companies have not been beneficial to the country in any way as he says this is the time for the government to have a second look at it for the betterment of the country.

Business News of Friday, 20 November 2020

Source: kingdomfmonline.com