An economist and Member of Parliament for New Juaben South, Dr. Mark Asibey Yeboah has said that until managers of the economy work hard to put the country’s credit ratings on a firm footing, there wouldn’t be any better deal for the country in terms of borrowing from the domestic and International markets.

The New Juaben South legislator insists that the current ratings of Ghana which now stands at B1, is downbeat for the prospect of the economy, saying this explains the reason why there is a trajectory of poor deals for the country in its borrowing spree from the International market.

“Our credit ratings just when Kufuor was leaving office was B3; Now this has spiraled to as low as B1. With this performance, investors will want to transact business with you on a high-interest rate because your credit worthiness is low,” Asibey told Kasapafmonline.com on Thursday.

The country is going with a deal of $1 billion with its fourth Eurobond roadshow at a coupon rate of 10.75%, a rate Dr. Asibey Yeboah has criticised as appalling, and hence will put the already distressed economy into jeopardy.

He said: “before an investor will demand such a rate, it means your economy is not in good health and so he or she fears that once the money is given you, you will not pay back and so there is the need to demand for higher premium.”

Meanwhile, Finance Minister Seth Tekper has indicated that Ghana has the best deal.

“The bond was oversubscribed, with orders exceeding US$2 billion compared to a target of US$ 1.0 billion.”

“The bond is a soft amortizing one with a tenure of 15 years amortising in years 2028, 2029 and 2030. The principal will be repaid in three instalments of US$333 million in years 2028 and 2029, and US$334 million in 2030. The 15-year tenure means that Ghana has become the first sub-Saharan African country outside South Africa to successfully issue a 15-year bond,” a release from the Ministry on Wednesday said.

Business News of Thursday, 8 October 2015

Source: kasapafmonline.com

'Gov’t won’t get a better deal with B1 credit ratings'

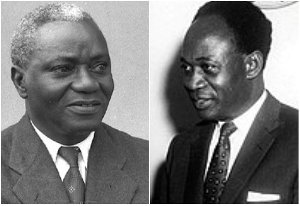

Dr. Mark Assibey-Yeboah

Dr. Mark Assibey-Yeboah