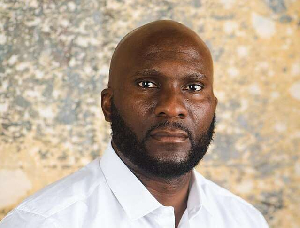

Gilbert Hie, Managing Director of Societe Generale Ghana, says the high interest rates on Government’s financial instruments has succeeded in enticing investors, denying banks in the country the much-needed resources to expand.

According to Mr Hie, who was speaking recently on the Ghana Stock Exchange (GSE) to explain the 2013 performance of Societe Generale, competition from Government was adversely affecting the operations of commercial banks.

He appealed to Government and the Bank of Ghana (BoG) to resolve problems relating to the country’s macro-economic performance in order to boost the operations of the commercial banks in the country.

Last year, he said Societe Generale posted a profit of GH¢36.36 million in 2013 as against GH¢30.27 million in 2012.

The bank also grew its interest income by 31.27 per cent, as shareholders’ funds increased from GH¢169.8 billion in 2012 to GH¢193.7 billion in 2013 despite the investment in the construction of its modern head office inaugurated early this year.

Customer deposits also increased from GH¢859 million in 2012 to GH¢926.1 million in the year under review as loans and advances to customers increased to GH¢740.4 million in 2013 compared to GH¢520.1 million in 2012.

Mr Hie said Societe Generale’s determination to develop products and services to meet the growing needs of its clients formed part of its “four pillars of ambitions” for this year, adding that these are aimed at offering excellent services with focus on building lifetime relationships with clients.

Touching on some new products of the bank, which will soon be introduced, Mr Hie mentioned the development of vendor co-operation to propose lease financing solutions, a new pensions fund for custody business and a happy chat loan scheme.

He said the bank had also segmented its customers in order to offer enhanced customer experience.

For 2014, he said Societe Generale would soon embark on a campaign that would focus on growing its deposit base.

The bank also intends to embark on an expansion drive to open branches in vantage places in Accra and other parts of the country in a bid to enhance ‘privilege banking.’

Business News of Tuesday, 27 May 2014

Source: Daily Guide