In the bid to lessen the demand for sovereign guarantees by international institutional investors who seek to make investments in Ghana, government is in the process of becoming a member of the Africa Trade Investment Agency.

Government has so far secured a grant of US$ 18.4 million from kfw, the German government-owned development bank, as part of the Compact with Africa, to pay for its shares, awaiting parliament’s ratification. This will enable ATI commence its operations in the country, providing globally acceptable insurance cover for investments made in Ghana by premium paying clients.

Subscription for Shares

The minimum share subscriptions that an African country needs to qualify for membership in the Agency is a minimum of 75 shares having a par value of US$ 100,000 each.

By this requirement, Ghana is expected to hold about 184 shares in the Agency.

Benefits

Once membership formalities in ATI are finalized, Ghana could benefit from gross political and commercial risk insurance cover on total investments and trade. This will ensure that the country leverages its membership of ATI to mobilize additional resources to finance trade and strengthen the productive sector by minimizing the commercial risk facing trade financiers and investors into the Ghanaian economy. Importantly it would remove the need for political risk insurance cover as is customarily demanded by international investors seeking to partner government to implement infrastructural projects.

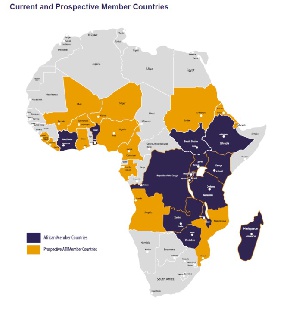

Presently, Benin and Côte d’Ivoire are the only two ECOWAS member countries that form part of the membership of ATI. However in this month, Nigeria has also initiated the process to be a member of the Agency, after it secured US$14.12 million from the African Development Bank for its share subscription.

In partnership with Economic Community of West African States (ECOWAS) and the African Development Bank, which is also a shareholder, ATI expects to expand further into West Africa.

In addition, ATI is also looking to broaden its international reach with prospective membership from national agencies of some of the world’s largest economies. For instance, the United Kingdom (UK) became a shareholder in ATI in 2016 through the membership of UK Export Finance (UKEF), the UK’s export credit agency.

Private Sector

With the mandate to provide medium to long term credit and political risk insurance, ATI makes available risk mitigation products to its member countries and related public and private sector actors.

These products are directly targeted to facilitate foreign direct investment as well as local private sector investment in regional member countries.

The ATI catalyzes private sector investments in infrastructure projects, thereby promoting economic integration of participating countries into regional markets.

Business News of Wednesday, 23 January 2019

Source: goldstreetbusiness.com

Ghana set to join ATI

Entertainment