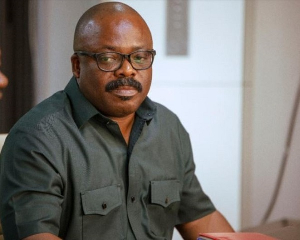

The Managing Director of Fidelity Bank Ghana, Julian Opuni, has outlined a compelling case for investment in Ghana’s rebounding economy.

In an interview with the Global Investor, a premier publication distributed at high-level summits across the world, Opuni provided a detailed roadmap for investors looking to navigate Ghana's financial landscape in 2025.

With Ghana’s GDP projected to rise, Opuni emphasized that the timing is right for strategic capital deployment.

“Ghana’s improving macroeconomic outlook should drive progress across sectors, fostering stronger conditions for investment and business growth,” Mr. Opuni stated in the interview.

He pinpointed four critical growth engines for the coming year: SMEs, agriculture, sustainable extractives, and regional trade.

Opuni highlighted the pivotal role of small businesses, noting that “SMEs form the backbone of Ghana’s economy, contributing to employment, innovation, and local value.”

He detailed Fidelity Bank's active role in this ecosystem, citing strategic investments and partnerships with the Mastercard Foundation and Proxtera.

These collaborations, he explained, “have enabled better access to capital and technical support for high-potential businesses, offering scalable and diversified opportunities for investors.”

On the agricultural front, Opuni was bullish on the potential of agri-processing.

“We view this sector as essential to food security, job creation, and foreign exchange generation,” he said. “Agriculture, especially horticulture and agri-processing, holds major potential.

Our work with FAGE, the Export Club, and initiatives like Bridge in Agric, which has disbursed over GH¢145 million, is helping to formalise and grow the sector,” he said. He noted that government programmes such as Feed Ghana are making the space more structured and attractive to investors.

Addressing the rapid digitization of Ghana's financial sector, Opuni described how Fidelity Bank is leveraging technology not just for efficiency, but for deeper inclusion.

“At Fidelity Bank, digital innovation drives both internal transformation and external growth; key pillars of a future-ready institution,” he told Global Investor. “We’re using automation to streamline operations, reduce costs, and improve speed,” he said. “Upgrades to our Mobile App and USSD platforms, plus innovations like Kukua, our WhatsApp banking assistant, have led to higher transaction volumes and stronger customer engagement.”

He further elaborated on the bank’s collaborative approach with fintechs to solve the problem of credit access for the underserved market.

“We’re also co-developing tools with fintechs that go beyond traditional banking, like cash-flow-based lending and behavioral credit scoring.

“This digital ecosystem is unlocking new opportunities for embedded finance and data-driven innovation,” Opuni explained.

With global capital increasingly seeking sustainable avenues, Opuni framed Fidelity’s ESG strategy as a core business driver rather than a peripheral activity.

“Fidelity’s sustainability strategy is built around three pillars: Sustainable Finance, Sustainable Operations and CSR,” he outlined.

He highlighted agriculture, renewable energy, and youth led enterprises as high potential segments.

He then pointed to the bank’s GreenTech Innovation Challenge and the Fidelity Young Entrepreneurs initiative as a prime example of how the bank supports ventures that are “scalable and aligned with both commercial and impact investor goals.”

He closed by reinforcing Fidelity Bank’s role as a long-term partner to Ghana’s growth sectors.

“In all these areas, Fidelity acts not just as a financier but as a partner, connecting SMEs with advisory support, technical expertise, and blended capital,” he noted.

All you need to know about Ghana's new vehicle number plates |BizTech:

Business News of Monday, 8 December 2025

Source: Fidelity Bank Ghana

Ghana's improving macroeconomic outlook should drive progress across sectors - Opuni

Entertainment