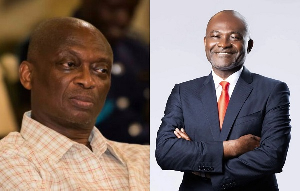

The Member of Parliament for Bia East constituency, Mr Richard Acheampong, has cautioned government against any attempt to contract more loans due to the rebasing of our economy.

He is warning Ghana may run into difficulties should we be deceived by the rebasing of the economy to contract more loans Ghana’s economy has expanded by 24.6 per cent for last year, according to rebasing figures by the Ghana Statistics Service (GSS). This was after the GSS reviewed the based year from 2006 to 2013 and the way of calculating economic growth for the country.

The revision should mean that the new growth rate for 2017 stands at 8.1 per cent compared to an old rate of 8.5 per cent. The economy is now worth GHC‚$256 billion as a result of the rebasing. If this is shared among a population size of 28.96 million, then everyone could get GHC8, 863. However, the GSS says this does not mean that growth has declined because the base of the economy has expanded.

Commenting on the issue, the legislator and member of the Finance Committee of Parliament said, ''a direct reflection of this should have reduced unemployment, led to the expansion of businesses, reduction in the cost of doing business, improve living conditions but mistakenly, our economy is not like that.

The activities being mentioned are in the service sector. And these services are foreign owned and they repatriate their profits. We have the numbers alright but it is not having direct reflection on the people.’’

‘’The activities are not done by government, they cannot create employment, they cannot generate any revenue for the government and the rebasing means your economy has expanded and so you may be able to contract more loans but the question is that, would have the resources to repay the interest and principal?

‘’Ghana must be very careful and should not be contracting loans because of the rebasing in order not to distress the country,’’ he warned. Mr Richard Acheampong said, the current administration is finding it difficult to pay arrears, nursing training allowances, Common Fund among other statutory payments ‘’and all these shows that, we do not have the space and the only way out is to borrow and that is why I am caution government o be careful.’’ He admonished government to look at the dynamics and avoid activities that could crash Ghana’s economy.

When asked to outline some of the activities that may crash the economy, he reiterated that, the major businesses in the telecommunications, oil and other financial sectors are foreign companies with few local businesses and ‘’these resources and profits are repatriated. The informal sector is unable to contribute any meaningful resources for government to invest in developmental projects.

And so, the concentration is on the foreign companies and if you are swayed by the figures and contract more loans, you will run into difficulties.’’ ‘’If we are not careful, we will run into difficulties because this government has the appetite of borrowing. They have demonstrated that through the loan they have presented before Parliament.

Our debt is increasing and yet we do not have a clear guideline on how they intend repaying these loans.,’’ he stated in an interview with Kwame Tutu on Frontline on Rainbow Radio 875.Fm. Meanwhile, policy think tank, Center for Economic studies has argued that;

Short-term revenue performance measures by the government could mean upward review of taxes in the 2019 budget.

Grants in aid of vulnerable sectors of the economy could dip further as has been the case post middle income status, coupled with exit signals from the donor community premised on government's undocumented policy of "Ghana Beyond Aid".

The tendency to interpret higher per capita income as a true reflection of improved livelihoods could provoke public anger. The Centre for Socioeconomic Studies (CSS), guided by these facts, believes that the post-rebasing focus of government should be on fiscal prudence through improved tax and non-tax revenue performance to spur productive expansion of the Ghanaian economy and accommodate the high expenditures building from numerous manifesto promises

Business News of Monday, 1 October 2018

Source: rainbowradioonline.com

Ghana's economy will crash if government continues borrowing - MP

Entertainment

Chez Amis CEO addresses NACOC arrest allegations

Opinions