Ghana needs about 290,000 Point of Sale (PoS) terminals with an estimated investment of $145 million to push the country into the arena of a cashless economy, Ghana Commercial Bank boss said on Monday.

PoS terminals which have been identified as critical to achieving the objective of e-electronic payments system, are electronic devices that enable customers to make payment to merchants in exchange for goods and services.

The GCB Managing Director, Mr Simon Dornoo speaking at a day’s panel discussion on achieving cashless society in Ghana, said research had shown that globally, leading countries with e-payments system had an average of 2,200 PoS terminals per 100,000 adults.

“How do we finance this investment and what is the appropriate role of each stakeholder in the development of the electronic payments system,” he asked participants at the discussion organized by the GCB as part of its 60th anniversary celebration.

It was held under the theme: ”Achieving a Cashless Society – The Role of Banks, the Government and the Customer” and attended by representatives from financial institutions, academia, the telecom sector, technology experts, policy makers and officials from the government.

The role players like the banks, the government and customers have to play in ensuring that Ghana move from cash to electronic forms of payment, were discussed.

Mr Dornoo said as a way of encouraging the use of its electronic cards, the GCB had set the pace by providing ATM (automated teller machine) service to its customers free of charge. In addition, he said the GCB was offering internet and mobile banking in addition to introducing PoS terminals.

A cashless regime envisions a society where goods and services are paid for by cards, electronic funds transfers or online, rather than with cash or cheque. Statistics show that while in the developed world more than 80 per cent of all financial transaction is done electronically, this is the opposite in Ghana.

Mr Dornoo said Ghana’s slow pace growth of the adoption of e-payments could best be explained from the long queues or overcrowding in banking halls where customers go to perform basic transactions such as depositing, or withdrawing funds all of which can be performed electronically.

He said: “The payments infrastructure has expanded and banking systems are now interoperable so the conditions are right to move a lot faster to join those countries that have made significant progress towards this goal.”

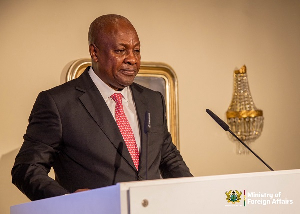

The Minister of Communications, Dr Omane Boamah, in statement read for him, noted that securing the understanding of the population to adopt the new payments system was critical to achieve the overall goal.

He called for education to be intensified not only in the urban areas but more in the peri-urban and rural communities.

Business News of Tuesday, 30 April 2013

Source: GNA