Ghana lost about GH¢26 million through the Electronic Money Issuers (EMIs), over the last two years, which is part of the financial crimes recorded over the period in the country.

The EMIs constitute the list of companies approved by the Bank of Ghana (BoG) to operate an electronic issuer and payment services for business transactions.

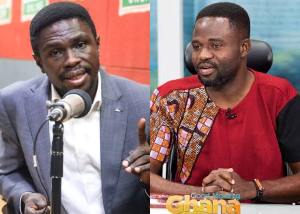

The Chief Executive Officer of Mobile Money Limited, Shaibu Haruna, disclosed this at the signing of a Memorandum of Understanding (MoU) between his outfit and the Economic and Organised Crime Office (EOCO) in Accra yesterday.

Commissioner of Police (COP) Maame Yaa Tiwaa Addo Danquah signed it on behalf of EOCO, while that of MML was signed by Mr Haruna.

The MoU is to help reduce trans-organised crime and fraud cases in the financial sector through effective collaboration.

“If I refer you to Bank of Ghana’s recent report on fraud in the industry, even though we saw a very slight increase in the number of incidents that were reported between 2021 and 2022, the value of what has been lost through mobile money has increased significantly. The report suggest that around GH¢26 million was lost through the EMIs,” he added.

Mr Haruna said, “Mobile money has become an integral part of our daily lives and as individuals and businesses, we are grateful to our consumers for supporting the growth of this business.”

He, however, expressed worry over the issues of fraud which had affected some of their activities, stressing that the “MML intends to use this collaboration or opportunity to actually work hard to combat the increased rate of fraud.”

“As a leading provider of digital financial service we owe it a responsibility to work collaboratively with the agency to support and drive request to make sure that our customers experience safe environment to transact their businesses as well as personal transactions,” he added.

Mr Haruna said customers were losing through these organised crimes and it was their responsibility to work collectively with all law enforcement agencies to ensure that these perpetrators were brought to book.

He said, “The MML has a strong policy that deals with any staff who engages in any negative practice, we apply the law and show them the exit.”

On her part, Mrs Addo Danquah expressed the need to stay ahead of criminals by collaborating with relevant agencies.

She said cyber-related incidents were emerging crimes, adding that the MoU would provide guidelines and develop training contents for investigators to be more knowledgeable in that area.

“Most people have been affected by this trans-organised crime and we need to work together to reduce it,” she added.

Mrs Addo Danquah said through collaboration, conviction of some suspects engaged in Subscriber Identity Module (SIM) swap had been secured recently, and this would serve as deterrent to other criminals.

She assured the public that EOCO would sustain its determination to collaborate with stakeholders to reduce trans-organised crimes in the country.

CoP Addo Danquah urged the media to partner EOCO in its sensitisation drive and appealed to the public to provide relevant information to law-enforcement agencies to clamp down on crimes in the country.

Business News of Thursday, 27 July 2023

Source: ghanaiantimes.com.gh

Ghana loses GH¢26m in two years through electronic money issuers - Shaibu Haruna

Entertainment