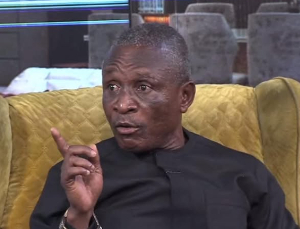

The Ghana Stock Exchange (GSE) is to embark on an extensive educational and promotional programmes as part of efforts to revive activities on the bourse, Francis Tweneboa, Managing Director of the Ghana Stock Exchange (GSE), said on Friday.

In addition, the exchange intends to automate clearing, settlement and depository system to enhance and attract strategic investors. "Rudimentary trading procedure is no longer the order of the day," Mr Tweneboa said, adding that, foreign investors who moved the market were more attracted to automated systems.

Mr Tweneboa talking to the GNA on the poor performance of the GSE last year, said the macro-economic difficulties in 2000, triggered disinterest in the market. First, there was a slump in world market prices of gold and cocoa, two of Ghana's major export commodities.

The All-Share Index, the market indicator closed at 955.95 points with a percentage change of the year registering only 11.42 per cent. In 1998, the GSE was adjudged a star in Africa for its sterling performance when the All-Share Index recorded a year high of 1,201.08 points.

Since then, the All-Shares Index, which gives the average capital yield, went into the red at negative 15.22 points in 1999, then improved to 16.55 points in 2000 and declined again to 11.42 points at the end of last year.

During 2001, the exchange recorded a year high of 1,025.78 points on August one but this declined steadily to close the year at 955.95 points.

Foreign inflow from exports therefore came in trickles leading to scarcity of hard currencies. "What exacerbated the situation is the increase in crude oil price which resulted among other things in government borrowing from domestic sources to support its expenditure.

"Government demanded money from local sources and had to attract investments in treasury bills by giving higher interests rates," Mr Tweneboa said, adding, that this brought about a general increase in bank rates as well.

There was shortage of the dollar and the cedi became weaker, he said, adding that the import of all these on the market were adverse.

Mr Tweneboa said following this, people who invested on the stock exchange turned their attention to the money market, which by then had discount rates of between 45 per cent and 48 per cent.

Some foreign investors who were the prime movers of the exchange also pulled out into other markets while others locked up their investments to watch the economy.

"The year 2000 was the worst year but there was a spill over into 2001 in which we recorded few large trades by foreigners but these were not as good as what we recorded in 1997 and 1998," Mr Tweneboa stated.

However, the situation ameliorated after the second quarter of the year to end of year 2001 when inflation declined from 40.5 per cent to 23.7 per cent, 91-day treasury bills discount rate slumped from 38 to 26.99 per cent, interest rate slumped and the dollar stabilised around 7,200 cedis.

Mr Tweneboa said the reduction in inflation and the real active stability of the cedi were signals to foreign investors that the economy was improving.

He said their return to participate in the exchange would revive activities and encourage local investors to take advantage of the current situation to invest on the bourse. This, he said, was because most of the equities had single digit price earning ratios, which meant that they were undervalued.

Mr Tweneboa said apart of education and automation, the Exchange intended to play its part of attracting investments by pursuing regional integration within the West Africa sub-region first and later with the southern Africa market.

The GSE has targeted the Nigerian and the Kenyan stock exchanges, and later the francophone stock exchange. The GSE's promotional campaigns were also targeted at companies in the Ghana Club 100.

The Managing Director said these were intended to widen the market base to afford listed companies the advantages of listing on other markets and give investors a variety of equities to invest in.

The GSE would also call for law reforms to strengthen transparency by listed companies, promote development of corporate bonds, encourage introduction of new products, derivative instruments, more venture capital funds and capacity building to promote efficiency of market players.

Mr Tweneboa admitted that the change in the trading system had not affected volumes of trade in terms of liquidity, prices nor demand. "Immediately, there has not been any discernible impact, but what it has done is to introduce an element of first come first served and afford brokers enough time to rediscover prices and trade realistically."

On the Ghana Government Index Linked Bond (GGILB), Mr Tweneboa said: "It is going to have a tremendous impact because it will cover substantial volumes in monetary terms." A unit of the GGILB would be traded for one million cedis.

Mr Tweneboa said trading in the GGILB would mean an increase in earning flow to the GSE from dealers who would pay registration and listing fees. "The amalgamation of a variety of investments on the bourse (shares, corporate bonds and government bonds) is a big plus to the GSE."

On the performance of individual shares, Mr Tweneboa said Aluworks was the star of the year, performing better than any of the other 21 listed equities. The company filed quarterly reports, which indicated its transparency.

The following is a summary of market activity for the year 2001 as against 2000:

2001 2000

Number of listed companies 22 22

Number of bonds:

Corporate 5 5

Government 17 0

Number of trading days 154 152Total turnover of equities

Volumes (In millions) 55.30 30.72

Value (In million cedis) 92.28 50.62

Total market capitalisation (billion) 3,904.03 3,655.04

Total number of listed issued shares 1,603.53m 1,487.21m

GSE All-Share Index:

End of period 955.95 857.98

Percentage change in index 11.42 16.55