Shareholders of FirstBanc First Fund, a money market mutual fund, have passed a special resolution to waive the fee applied at the time of the initial purchase of an investment for all institutional clients.

The waiver would apply to qualified institutional investors, regardless of the minimum amount of deposit.

The previous decision to waive the front load approved by shareholders in 2016 applied only to institutional investors with a threshold deposit of GH¢500,000.

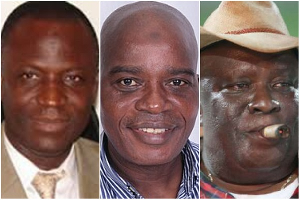

Mr Amenyo Setordzie, the Managing Director FirstBanc, said the current decision was taken to attract institutional investors, who could not meet the previous threshold of GH¢500,000 at a go but could do so in a matter of weeks.

“Most Pension Funds invest based on a build-up approach; that is, most of their individual deposits do not meet the minimum GH¢500,000 needed to qualify for a waiver, even though on a build-up basis their funds normally get to the threshold over a short period,” he said.

He said the waiver would make available funds that would have otherwise gone to the Manager as charges and invested for the eventual benefit of all shareholders.

Total institutional deposits in 2016 was GH¢6.3 million compared with GH¢10.3 million in 2017, a 63 per cent growth after the front load waiver in 2016.

Mr Setordzie said as institutional investors took advantage of the waiver, it would lead to faster fund growth, increased market bargaining power and consequently lead to better returns on the Fund.

Meanwhile, the First Fund posted an impressive annualised yield of 28.33 per cent in 2017, maintaining its position as the best performing money market mutual funds in Ghana.

Addressing shareholders at the Annual General Meeting of the First Fund, Board Chairman Professor Cletus Dordunoo, said the good performance was achieved despite the reduction in treasury rates and general market rates.

He said Asset Under Management (AUM) went up by 79 per cent from GH¢76.39 million in 2016 to GH¢136.78 million on the back of remarkable return on investments in the fund and the contributions by both existing and new clients.

“In 2017, a lot more investors signed on to the Fund, increasing client base by 36 per cent to 19,134 from 14,774 in 2016, its highest year-on-year increase for the past five years,” he said.

Prof Dordunoo urged shareholders to continue investing in the fund as it was poised to deliver good returns in 2018, adding that, the board remained committed to growing the Fund to maintain its position as the premier money market mutual fund in Ghana.

Mr Dennis Appiah Kubi, Fund Manager, said he would increase exposure to relatively strong banks and treasury securities, bearing in mind the heightened banking industry risks.

“Even so, we will monitor macro-economic conditions and tactically adjust accordingly as and when deemed necessary,” he said.

Meanwhile, FirstBanc Heritage Fund, a long-term equity market mutual fund, made a return of 41.52 per cent at the end of 2017. GNA

Business News of Wednesday, 20 June 2018

Source: ghananewsagency.org