Mr Seth Aklasi, Chief Executive Officer (CEO) of Donewell Insurance Company Limited has indicated that the influx of fake insurance stickers on the market was creating a leakage in the insurance industry.

He described the act as one of the major challenges facing the industry and was currently giving insurance companies problems.

He noted that people only get to know that the sticker on their vehicles was not genuine when it was time for them to make a claim.

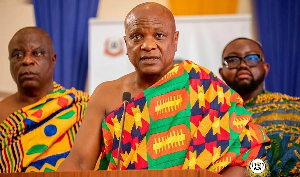

Mr Aklasi who was speaking on the sidelines of a press launch of Donewell Insurance Company’s 25th anniversary said what the perpetrators do was that they clone the insurance stickers and sell it to people.

“At the last insurance companies CEO’s meeting with the industry regulatory body; National Insurance Commission (NIC) the situation was brought to their knowledge and they asked that we give them up to May of this year to salvage the situation.”

He said the NIC will soon create a database for insurance stickers so that each time one buys an insurance the person can send a short code to confirm if the sticker purchased was genuine or not.

“I urged Ghanaians to avoid giving patronage to this unlawful activity and use this opportunity to plead with the regulator to use all channels to fight this scourge and sanitize the general business insurance industry.”

Donewell Insurance Company launched its 25th anniversary with a promise to ensure high standards in the delivery of their services to enhance trust and confidence in the insurance industry.

Mr Aklasi said over the period, the company has delivered outstanding value to its customers in the financial, construction, education, mining and public sectors as well as private individuals.

This, he said was achieved on the back of continuous innovation in systems and processes aimed at enhancing service delivery.

In view of that he said the company was also seeking to adopt new technologies to identify consumer trends and client behaviour in the rapidly changing world of technology.

“Donewell has positioned itself to be a key player in the rapidly growing and expanding insurance industry by raising the necessary capital that gives it the muscle to fund its growth aspirations.”

Mr Aklasi noted that the company was fully capitalized and has exceeded the minimum capital requirement of GH¢15 million by the National Insurance Commission (NIC) with an equity of GH¢23 million.

He, however, indicated that the company would continue to focus on its financial base to meet any increase in the minimum capital that would be required by the NIC.

Business News of Friday, 6 April 2018

Source: thefinderonline.com