Business News of Tuesday, 30 March 2021

Source: bog.gov.gh

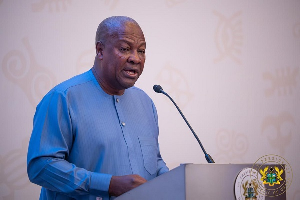

FULL TEXT: BoG Governor's remarks at inauguration of Zeepay edifice

Good Evening. I am honoured to be here for the inauguration of this New Head Office of Zeepay Ghana Limited.

This edifice exemplifies the achievement of an indigenous FinTech company, working within a conducive payment systems regulatory environment provided by the Bank of Ghana.

Ladies and Gentlemen, Financial technology innovations are permeating the entire financial services value chain. From wholesale payments, to retail and commercial banking, customer relationships and payment services.

FinTechs find applications for the entire spectrum of financial services, and FinTechs are disrupting every facet of traditional financial services businesses. One of such fintechs is Zeepay which is the first indigenous fintech to be licenced as an Electronic Money Issuer by the Bank of Ghana.

Zeepay’s innovative skills, mindset and achievements provide evidence that the Bank’s regulatory policies for the Fintech ecosystem, have laid a solid foundation for a collaborative strategic partnership with Banks are beginning to yield the desired results.

With the future of banking resting on digital technology, the Bank has created the right conditions to nurture and harness the talents and creative skills of young Ghanaian innovators into the financial space.

So far, the impact of innovative Fintech-driven financial products and services has been phenomenal. From employment creation to foreign direct investments’ technology transfer and skills enhancement to financial inclusion, the footprints of FinTechs are visible.

These positive developments place a lot of responsibilities on FinTechs to operate efficiently and remain compliant with the relevant laws, directives, and policies of the Bank.

This is the only way that we can build consumer confidence and trust in financial digitisation, as well as ensure the delivery of sustainability of the financial products and services that are churned out by FinTechs.

With the massive investment in this new building, I will therefore urge the Management of Zeepay to set the tone in the Fintech sector with strict compliance to the regulatory framework.

As a central bank, our commitment to harness the potential of technology to build safe, efficient and inclusive financial service industry has been adequately demonstrated in the National Payment Systems Strategy 2019 – 2024 and the Payment Systems and Services Act 2019 (Act 987).

In addition, we have recognised the diverse business models of Fintechs and designed a licensing application pack that is based on proportionate regulation.

Furthermore, we have established a regulatory and innovation sandbox to provide an appropriate environment to nurture innovative products, services and business models.

All these policies seek to assure payment service providers and customers that the Bank will continue to fashion out forward-looking policies to engender growth through competition, innovation, and continuous value-creation in the payment ecosystem.

Furthermore, Ladies and Gentlemen, the Bank recently issued policies to guide the operations of Dedicated Electronic Money Issuers and Payment Service Providers in the areas of Crowdfunding, Inward Remittance and Regulatory Sandbox.

The inward remittance policy for example, will help Zeepay Ghana Limited and other FinTechs to actively drive innovation in the remittance space, thereby increasing competition and reducing cost.

On the consumer side, the Bank has worked with the industry to reduce charges on mobile money interoperability to a maximum of 1 percent.

This will ease customers’ financial transactions within the mobile money interoperability system, foster the adoption of digital financial services, and deepen financial inclusion.

Also, the new directive on merchant categorization will ensure that micro, small and medium-sized enterprises that are not registered as corporate entities can now have access to merchant wallets.

This is expected to entrench the adoption of digital payment services in the informal sector. 7.0 We hope that these ongoing orderly developments of a safe, vibrant, and innovative digital financial service ecosystem will form the basis for banks, SDIs, payment service providers, and dedicated electronic money issuers to collaborate and create true value for consumers.

On this note Madam Chair, let me once again congratulate the Board, Management, and Staff of Zeepay Ghana Limited on the opening of this new Head Office building.

We encourage you to continue with the hard work, maintain high standards of integrity, particularly in the areas of corporate governance and regulatory compliance, to maintain public confidence in Zeepay Ghana Limited.

Thank you.