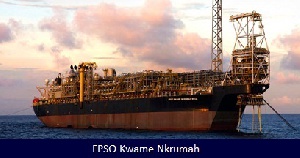

Tullow Oil PLC has announced that FPSO Kwame Nkrumah will be shut down for 21 days in September, this year to allow for routine maintenance occasioned by a recent water injection pump failure on the facility.

This is expected to have a short-term impact on oil production for the second half of 2013. The test, coupled with work on the gas handling constraints on the FPSO and the decision to drill an additional gas injection well which will be completed in the fourth quarter of 2013, would result in a 2013 exit production rate of over 120,000 bopd.

Since late 2012, the Jubilee oilfield production has steadily increased and is currently at a rate of around 110,000 bopd but production is expected to average around 95,000 bopd for the full year after an average first half production of 104,000 bopd. The Jubilee Oilfield is Tullow’s flagship offshore operated asset contributing around 40 percent to the Group’s overall production.

Testing of the FPSO facilities, which was completed in March 2013, indicated an oil system capacity in excess of 125,000 bopd. The Jubilee Phase 1A development project has successfully increased well production capacity and enhanced the recoverable reserves potential from Jubilee. The remaining three Phase 1A producers and two water injectors are scheduled to be completed over the course of the next 12 months.

The Full Field Development Plan detailing how the Jubilee Oilfield will be fully developed in the coming years to maximize recoverable reserves and maintain the field production at its peak capacity, is being considered by the Government of Ghana The Group plans to farm down its current equity in the TEN Development and Production area in Ghana in return for a development carry from the TEN Project.

“This will enable Tullow to manage its exposure to development spend over the coming years whilst retaining a material interest and operatorship of the high value oil production expected to commence in mid-2016. This will substantially enhance the Group’s cash flow and financial strength.

When a licensed exploration company strikes oil or gas, it may sell a share in its rights over the discovery to other companies and this is called a “farm-down,” which is a common practice among small exploration companies. It enables them to share with others the investment costs and technological challenge of getting the oil out of the ground and onto world markets.

Business News of Monday, 5 August 2013

Source: Daily Guide