Over the last few years, successive governments have resorted to domestic and international Debt Capital Markets (DCM) to raise funds for large investments in programmes and infrastructure, budget deficit and operational expenses that support the development of Ghana. In this article, I will try to give some perspective of the future of the Ghanaian secondary bond market, address some of the concerns and opportunities thereof. I will start with a ‘Bond 101’ theoretical view of the bond market.

Basic Definition

A bond is a debt investment in which an investor loans money to an entity (typically corporate or government) which borrows the funds for a defined period at a variable or fixed interest rate (coupon). Bonds are used as an alternate source of funding by companies, municipalities, states and sovereign governments to raise money to finance a variety of projects, to maintain ongoing operations or to refinance existing debts.

So in effect, owners of bonds are debtholders or creditors of the issuer. Bonds are commonly referred to as fixed-income securities and are one of the three main generic asset classes, along with stocks (equities) and cash equivalents. Many corporate and government bonds are publicly traded on exchanges, while others are traded only over-the-counter (OTC). The indebted entity (issuer) issues a bond that contractually states the interest rate (coupon) that will be paid and the time at which the loaned funds (bond principal) must be returned (maturity date)

Characteristics of Bonds

Face value is the amount the bond will be worth at its maturity, and is also the reference amount the bond issuer uses when calculating interest payments. Coupon rate is the rate of interest the bond issuer will pay on the face value of the bond, expressed as a percentage. Coupon dates are the dates on which the bond issuer will make interest payments. Typical intervals are annual or semi-annual coupon payments.

It is important to note that maturity date is the date on which the bond will mature and the bond issuer will pay the bondholder the face value of the bond. Issue price is the price at which the bond issuer originally sells the bonds.

The issue price of a bond is typically set at par, say a GHS100 or GHS1,000 face value per individual bond. The actual market price of a bond depends on a number of factors including the credit quality of the issuer, the length of time until expiration, and the coupon rate compared to the general interest rate environment at the time.

Because fixed-rate coupon bonds will pay the same percentage of its face value over time, the market price of the bond will fluctuate as that coupon becomes desirable or undesirable given prevailing interest rates at a given moment in time. For instance, if a bond is issued when prevailing interest rates are 6% at GHS1,000 par value with a 6% annual coupon, it will generate Ghs60 of cash flows per year to the bondholder. The bondholder would be indifferent to purchasing the bond or saving the same money at the prevailing interest rate.

If interest rates drop to 5%, the bond will continue paying out at 6%, making it a more attractive option. Investors will purchase these bonds, bidding the price up to a premium until the effective rate on the bond equals 5%. On the other hand, if interest rates rise to 7%, the 6% coupon is no longer attractive and the bond price will decrease, selling at a discount until it’s effective rate is 6%. Because of this mechanism, bond prices move inversely with interest rates. So, it is important to gauge the level of interest rate and the associated bond prices.

Two features of a bond (credit quality and duration) are the principal determinants of a bond’s interest rate. If the issuer has a poor credit rating, the risk of default is greater and these bonds will tend to trade a discount. Credit ratings are calculated and issued by credit rating agencies such as Fitch, Standard and Poor’s (S&P) etc. Bond maturities can range from a day or less to more than 30 years. The longer the bond maturity, or duration, the greater the chances of adverse effects.

It`s interesting to note that longer-dated bonds also tend to have lower liquidity. Because of these attributes, bonds with a longer time to maturity typically command a higher interest rate. In Ghana, the longest bond maturity is the 15-year Government of Ghana bond trading with total outstanding balance of Ghs4.7bn as at October 2018. When considering the riskiness of bond portfolios, investors typically consider the duration (price sensitivity to changes in interest rates) and convexity (non-linear relationship of bond prices to changes in interest rates.

Bond Categories

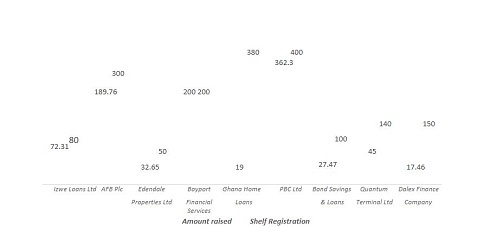

There are three main categories of bonds – corporate bonds, municipal and Government Bond. Corporate bonds are issued by companies (Bayport, Ghana Home Loans etc). Municipal bonds are issued by states and municipalities which could be the likes of Accra Metropolitan Assemblies (AMA), Kumasi Metropolitan (KMA) etc. Elsewhere, municipal bonds can offer tax-free coupon income for residents of those municipalities just to attract local investors.

There are varieties of Bonds on the market. Zero-coupon bonds do not pay out regular coupon payments, and instead are issued at a discount and their market price eventually converges to face value upon maturity. The discount a zero-coupon bond sells for will be equivalent to the yield of a similar coupon bond. Convertible bonds are debt instruments with an embedded call option that allows bondholders to convert their debt into stock (equity) at some point if the share price rises to a sufficiently high level to make such a conversion attractive.

However, some corporate bonds are callable, meaning that the company can call back the bonds from debtholders if interest rates drop sufficiently. These bonds typically trade at a premium to non-callable debt due to the risk of being called away and also due to their relative scarcity in today’s bond market. Other bonds are puttable, meaning that creditors can put the bond back to the issuer if interest rates rise sufficiently.

The Ghana Secondary Bond Market

Following the growing interest in the secondary market, the Ghana Fixed Income Market (GFIM) was established to facilitate the secondary trading of all fixed income securities and other securities to be determined from time to time.

The market has been established by key stakeholders in the financial market led by the Bank of Ghana (BoG), Ghana Stock Exchange, (GSE), Central Securities Depository Ghana Ltd (CSD), Ghana Association of Bankers, the Ministry of Finance, Financial Market Association (ACI Ghana) and Licensed Dealing Members (LDMs) of the Ghana Stock Exchange. The GFIM is based on the existing license that the Ghana Stock Exchange (GSE) has to operate a market for securities.

The GFIM would within the initial years of its existence, operate under a governing committee of stakeholders. However, because GFIM is not a separate company yet, the Council of the GSE has ultimate responsibility for the market. The main regulator for the market is the Securities and Exchange Commission. The Bank of Ghana is consulted on matters to do with the requirements and responsibilities of primary dealers as far as the market is concerned and certain types of products to be dealt in on the GFIM, such as money market instruments.

As at the end of October 2018, GFIM had 40 registered members categorized as follows: Sixteen (16) Licensed Dealing Members, Thirteen (13) primary dealer banks and Eleven (11) non-primary dealer banks.

In terms of Securities trading, there were are also Fourteen (14) benchmark Securities which had a One (1) 15yr Government of Ghana Bond, thirteen (13) non-benchmarked Securities, forty-three (43) treasury notes, Treasury bills notes comprising of Twenty-Six (26) 182-day bills, Thirteen (13) 91-day bill and Seven (7) Ghana Cocoa Bills. Two (2) local US Dollar 2 and 3year bonds respectively and Four (4) Eurobond. There are also Ten (10) Corporate Bonds currently listed.

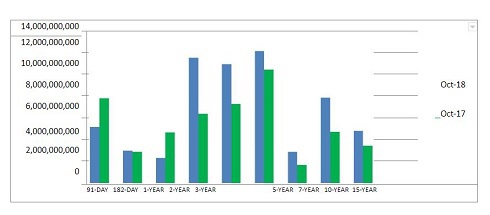

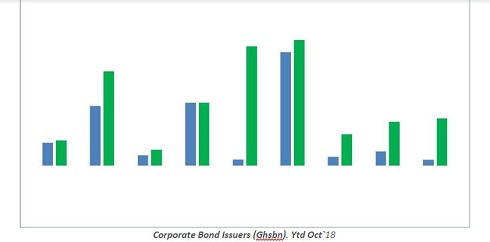

With regards to the Government of Ghana securities, the total outstanding securities at as October 2018 had grown to Ghs60.6bn (2017: Ghs49.2m) representing a 23.2% growth year-on-year. The growth was largely seen on the 10year tenor securities which inched up from Ghs4.7bn to Ghs7.9bn in 2018. With a shelf value of Ghs11.8bn, the forty-one (51) corporate bond listed had raised Ghs6.6bn representing 56% achievement. All these securities are traded on Central Securities Depository (CSD) and Blomberg e-bond trading platform.

Trend Analysis of Total GoG outstanding Securities (Ghs)

Corporate Bonds raised vs shelf registration

ESLA PLC bonds programme is an outlier and was not included in above analysis. However, had raised about Ghs5.6bn against a shelf registration of Ghs10bn.

The Ghana Fixed Income Market (GFIM) looks very promising and I believe the intention of this government and its Economic Management Team (EMT) who is seeking for fiscal consolidation will further deepen the secondary market. However, industry watchers are of the view that the more the government borrows, the higher the public debt to get Gross Domestic Product (GDP) and this must be carefully looked at.

Following the successful establishment of the ESLA PLC bond programme in 2017, Government had steadily settled over Ghs5bn in legacy debts and aged payables towards the goal of a financially viable and competitive power sector. An audit exercise is currently underway to validate the aged payables that were not considered under the ESLA bond. Once confirmed, government will intervene with a combination of cash and bonds to pay off the valid debts. This presents a huge opportunity to players in the bond industry and ecosystem.

Government has confirmed its commitment to borrow at “least cost” and at the minimum prudent level of risk. Consistent with this, Government intends to issue sovereign bonds (Eurobond/Green bond) of up to Usd3bn, to be used to finance critical infrastructure projects and for liability management.

The Finance Ministry has also announced its intention to issue long dated sovereign Century Bond aimed at putting Ghana on a firm trajectory of growth and prosperity. This could be in the form of green bonds or Eurobonds on the international capital markets

A cross-section of Ghanaians is of the view that Municipal and District Assemblies are to be self-financed and the onus is on MMDAs to issue bonds to defray their debts.

The future is bright

In the light of the above, the future of the Ghanaian Secondary Bond Market looks very exciting. However, one major problem hampering the development of capital markets includes bond pricing. In sub-Saharan Africa, coupon rates appear too high, hovering around 9.5% in Kenya, Angola, Ghana and Senegal as as per the table below. The important question one would ask is that, are bond issued by African governments priced at the rates comparable to the rest of the world. In an article by Michael Olabisi, titled Journal of Africa trade, volume 2 issued on 2nd December 2015. The research indicated that based on data sourced from data stream to analyse bond issuance from 2005 to 2014, coupon or interest rate paid by sub-Saharan African countries ranked Ghana as one of the countries with high coupon rate. This is really something the governments must watch.

The yield curve for a few sub-Saharan Africa USD Eurobonds

I would, therefore, implore local and international investors to take advantage of the sound macroeconomic policies, coupled with investor confidence to help develop the market. Corporate issuers have to take advantage of the cheaper sources of funding. MMDAs can depend on bond issuance to develop their municipalities.

Credit; Investopedia, Securities and Exchange Commission (SEC), Ghana Stock Exchange (GSE), 2018 Budget Statement

Business News of Saturday, 15 December 2018

Source: Carl Odame-Gyenti