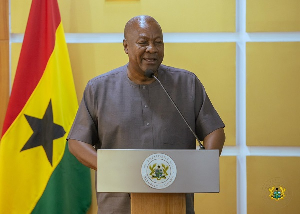

The Country Managing Partner of Deloitte Ghana has urged the government to consider extending the International Monetary Fund (IMF) program by a year or two because of the numerous gains the country has achieved so far.

Ghana signed onto an IMF bailout program in May 2023, securing a US$3 billion Extended Credit Facility (ECF) to stabilise the ailing economy. However, the programme is to end in June 2026.

But speaking on the sidelines of the 9th Ghana CEO and Summit, Owusu said the programme has brought elevated investor confidence, both domestic and external, adding, “The programme has brought fiscal discipline, which we haven’t done well without the IMF.”

He mentioned that the Ghanaian economy showed some resilience, particularly in 2024, despite the turbulence in previous years, growing at a rate of 5.7%, driven mainly by the mining and quarrying sub-sector.

To him, the current growth trajectory requires the country to restructure the economy if it’s to create real and decent jobs and significantly increase government revenue and reduce the overdependency on aid.

“This is the reason I support the President’s idea of a reset," he said.

He lamented that the over-reliance on the services sector could come as a disincentive because it would not generate the needed jobs for the growing labour market.

He quoted that over 150,000 students graduate from the country’s universities annually, and that requires a bold and ambitious plan to create opportunities for them.

He again urged the government to implement its agriculture programs captured in the 2025 Budget, stating that the ‘Feed Ghana’ and ‘Feed the Industry’ initiatives are very important.

He said the initiative will not only feed the nation but also serve as raw materials for the manufacturing industries, create jobs in the agriculture value chain and the manufacturing sector, and address the high food inflation.

“These policies must be implemented with clear-cut strategies and targeted timelines to enable the government to achieve its vision,” he added.

On the balance of payment front, he warned that the positive balance of payment is likely to be impacted when Ghana starts servicing its external debt from May 2026 and beyond.

“This could affect our foreign reserves and consequently the cedi," the Deloitte boss noted.

He commended the government for the good work done so far on the economy but called for a continued increase in the country’s reserves to sustain the performance of the local currency.

“We cannot continue to rely on cocoa as our main cash crop. We must deliberately diversify the Non-Traditional Exports base by targeting other cash crops such as oil palm, shea nut, rubber, and cashew. We must grow these into cash-cow commodities that will bring in the much-needed earnings in foreign exchange," he added.

On inflation, Owusu stressed that if the cedi can sustain its recent stability and supply-side factors, it can be improved to ease the rise in food prices, “we should see a gradual decline in inflation towards the 11.9% year-end target noted in the Budget Statement.”

SSD/EB

Removal of E-Levy will boost financial inclusion – BoG

Business News of Tuesday, 27 May 2025

Source: www.ghanaweb.com

'Extend IMF program, it has brought us numerous gains' – Deloitte boss tells government

Entertainment