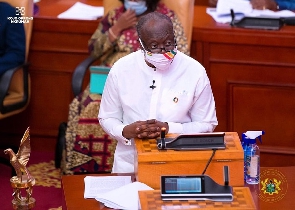

Ghana’s public debt burden has been brought into sharp relief by figures provided to Parliament on October 28, 2020 by Finance Minister Ken Ofori-Atta.

In all he has requested Parliament to approve GH¢27,434,180,520 as appropriation for government to finance its activities for the first quarter of 2021.

However, the second largest expenditure item – after the GH¢7,708,960,148 budgeted for the wages of public sector workers – is GH¢7,002,221,941 to be used to pay interest on the public debt during the first three months of the year.

Further to this is another GH¢3,419,583,605 allocated for amortization of debt. Combined with the interest payments allocation this adds up to GH¢10,421,805,546 in total for debt servicing. This is 34 percent of the total appropriation needed for the first quarter.

Public finance analysts are already sounding the alarm bells. The first quarter appropriation following a general election year is basically just to keep government running while the winners of the election put together a full year budget.

This means expenditure is kept to the barest minimum; for instance, capital expenditure is only allocated GH¢1,903,658,408 out of the appropriation requested.

Nevertheless, with debt servicing taking 34 percent of the appropriation, the statistics give a clear indication of Ghana’s fiscal state as a result of the impact of COVID-19, which has imposed a record high fiscal deficit of 11.4 percent of Gross Domestic Product on the country.

Indeed it is instructive that for 2021 a fiscal deficit of 8.6 percent is now being projected, which itself is an improvement on the 9.4 percent originally forecast.

However even with the enlarged deficit, government’s expenditure on goods and services, subsidies, social benefits arrears clearance and the likes are all being crowded out by debt servicing imperatives, as the public debt reaches an estimated 76 percent of GDP according to the latest projections from the International Monetary Fund.

Ghana’s public debt has increased dramatically during 2020 due to a combination of forced new borrowing due to the effects of COVID-19 on both public revenues and public expenditure requirements, as well as short term debt servicing relief this year provided by bilateral creditors, with interest payments due but not paid being capitalized.

Public finance analysts are new expecting debt servicing to snatch away between 40 percent and 45 percent of public revenues for the full year 2021.

Business News of Saturday, 31 October 2020

Source: goldstreetbusiness.com