TechnoServe, a non-profit organisation with funding from the Department for International Development (DFID), is currently implementing a multi-year enterprise development project dubbed: “Enhancing Growth in New Enterprises (ENGINE).”

The project is to support 500 micro and small enterprises to overcome barriers to growth and improve competitiveness by equipping them with the necessary skills.

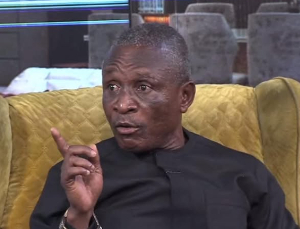

Mr Francis Opoku-Mensah, the Enterprise Finance Manager, TechnoServe, told the Ghana News Agency that it was also to resource them to improve on their business plans and internal operations.

“It’s to create a thriving community of entrepreneurs through increased access to business development services and finance,” he said.

He said in order to link the entrepreneurs to financial institutions, Technoserve, the implementing agency for the ENGINE project, organised the maiden edition of an Investor and Financing Dialogue Session targeted at facilitating linkages and deal flow between the two groups.

The dialogue session provided an opportunity to network and initiated the development of a new portfolio in the Small Medium Enterprises (SMEs) sector.

He said it also created a network of investors and financiers who could provide credit facilities to support SME businesses under the programme.

Mr Opoku-Mensah said the first 100 finalists were selected through the ENGINE Business Plan Competition and Entrepreneurship Development Programme.

He said many of the financial institutions lauded DFID for supporting an initiative that provided cash and “in-kind” awards in the form of seed capital and aftercare support services to SMEs.

Mr Opoku-Mnesah said the intervention would allay the fear of providing credit facilities to SMEs adding that SMEs ought to know exactly what was expected of them before submitting requests to financial institutions.

The session attracted participants from the banking sector, savings and loans companies, impact funds, private equity firms, venture capital firms, micro-finance institutions and other specialised funding agencies.

Business News of Friday, 17 April 2015

Source: GNA