Ghana's $1.5 billion Eurobond issue due later this month is expected to boost the flagging cedi.

The cedi could begin a gradual recovery against the dollar in coming weeks on offshore greenback sales, boosted by expected Eurobond and cocoa inflows, traders said.

The local unit has remained stable in the past two weeks, after plunging about 30% in the first half of the year due to a shortage of dollars and concerns over a weak economy.

Analysts forecast depreciation at a significantly lower pace in the second half of the year as cocoa inflows kick in.

"The cedi's depreciation has eased significantly as a result of this improvement in (offshore) inflows. We are likely to see some gains in local currency (against the greenback) if forex improves further," a Barclays Bank Ghana analyst said.

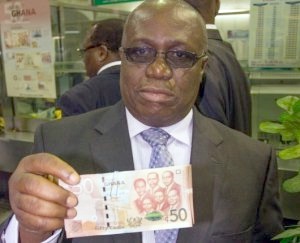

Finance Minister Seth Terkper on Wednesday cut the government's 2014 growth target and forecast a wider budget deficit and higher inflation, citing falling revenues, the slide of the cedi and declining gold prices.

Ghana is set to issue a third Eurobond of up to $1.5 billion later this month. The government will also sign a syndicated loan of $2 billion for next year's cocoa purchases, Terkper said, noting that the inflows will boost the country's reserves in support of the cedi.

Business News of Wednesday, 23 July 2014

Source: The Finder

Cedi seen firming ahead of Eurobond

Entertainment