The Chartered Institute of Bankers, Ghana (CIB Ghana) has conferred fellowship honours on 18 heads of financial institutions and individuals for their immense contribution towards the progress of their institutions and the Institute.

The honours would enable the fellows to use the title ‘Fellow of Chartered Institute of Bankers” (FCIB), against their names.

They included; Dr Maxwell Opoku Afari, First Deputy Governor of the Bank of Ghana, Mrs Elsie Addo-Awadzi, the Second Deputy Governor of the Bank of Ghana, Mr Anselm Ransford Adzetey Sowah, the former Managing Director (MD), GCB Bank Ghana Limited, and Mrs Abena Osei-Poku, the MD of Absa Bank Ghana Limited.

Others were; Mr Daniel Nii Kwei-Kumah Sackey, the MD of Ecobank Ghana Limited, Mrs Mansa Nettey, the Chief Executive Officer (CEO) of Standard Chartered Bank Ghana Ltd, Mr Daniel Wilson Addo, the CEO of Consolidated Bank Ghana, Mr Julian Opuni, the MD of Fidelity Bank, Mr Alex Awuah, Deputy MD of ARB Apex Bank, and Mr Ben Amenumey, the CEO of UMB.

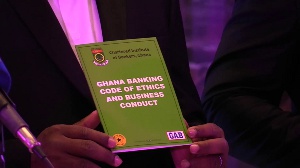

The Institute, in collaboration with the Ghana Bankers Association and the Bank of Ghana, also launched the “Ghana Banking Code of Ethics and Business Conduct”, to serve as a bedrock and guide to all practitioners to maintain best banking practices and strong commitment to sound ethical and professional standards in the banking industry.

Mrs Patricia Sappor, the President of CIB Ghana, said the Code would ensure that Chartered Bankers continued to play critical roles in the banking Industry and distinguished themselves on account of the significant contributions they made to the banking profession, which was the only qualification customised to the core practice of banking.

Speaking on some interventions of the Bank of Ghana, she said the recapitalisation directive it gave was one of the key pillars in ensuring a resilient, liquid, profitable and well capitalized sector with the industry’s capital adequacy ratio of 20 per cent as at October 2020, well above the regulatory 13 per cent prudential limit under the Basel II/ III framework, even amid COVID-19.

She said banks worldwide were undergoing rapid transformation in their business models through innovations in technology and shifts in customer expectations, adding that, the knowledge and application of megatrends in technology were also shaping the global banking landscape.

The landscape included open banking also known as "open bank data” through the use of Application Programming Interfaces (APIs), Blockchain and cryptocurrencies, an invention that is fast changing the world, data analytics for business analysis and decision-making, and responsible banking that advocates profits with purpose.

Dr Ernest Addison, the Governor, Bank of Ghana, said the banking industry deserved commendation for the positive response to the Bank’s monetary policy actions and regulatory relief measures, especially in the wake of the COVID-19 pandemic.

Following the announcement of the pandemic, he said banks had provided various reliefs to customers through a reduction in lending rates, granted moratoria on loan repayments, restructured existing facilities, and advanced new loans to customers.

Going forward, Dr. Addison said, the financial sector would require constant regulatory and policy attention to mitigate the risks, as the economic impact of the COVID-19 pandemic might result in higher non-performing loans and some capital erosion of banks.

He mentioned poor asset quality, lack of profitability, loss of capital, excessive leverage, excessive risk exposure, and poor conduct and liquidity concerns as some of the symptoms of a weaker bank.

The Governor said the symptoms could occur due to an economic downturn but were often caused by inappropriate business models, poor governance, poor decision making by senior management and misalignment of internal incentive structures with external stakeholder interests.

The BoG was, therefore, putting greater focus on identifying the early warning signals and initiating prompt corrective action to resolve them, he said.

Dr. Addison advised banks to be vigilant and upgrade their capabilities, improve governance and risk culture, saying, the BoG was optimistic that together with the banking industry, they would build a robust, resilient and capable financial sector to support Ghana’s Beyond Aid Agenda.

The Chartered Institute of Bankers, Ghana promotes the study of banking and regulates the practice of the banking profession in the country.

Business News of Sunday, 29 November 2020

Source: GNA

CIB Ghana confers 2020 fellowship honours and unveils Code of Ethics

The effective implementation of the Code will foster integrity discipline and etiquette in the banks

The effective implementation of the Code will foster integrity discipline and etiquette in the banks