Business confidence as measured by the index derived from the Bank of Ghana’s (BoG) Business Confidence Survey, has shown a recovery in the sentiment of the business sector.

Following dampening sentiments of business during the second survey in June 2019 at 94.1 percent from 94.3 percent in April 2019, the survey conducted in August 2019 improved at 98.1 percent.

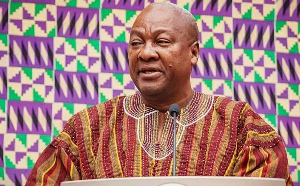

The rebound reflects the business sector’s optimism about current and future economic prospects, said Dr. Ernest Addison, Governor of the central bank.

This economic indicator measures the amount of optimism or pessimism that business managers impression about the prospects of their companies, as well as providing an overview of the state of the economy.

The Business Barometer Indicator (BBI) of the Association of Ghana Industries (AGI), also showed a bounce back in confidence in the sentiments of business sector in the first quarter of 2019 from the previous quarter.

The Business Barometer Indicator recorded a rising confidence from 99.8 in first quarter to 103.2 points for the second quarter of 2019.

However, industry pointed out five keys challenges that were countered during the second quarter as including the high cost of electricity as the leading impediment, high cost of raw materials, cedi depreciation, and delayed payment in relation to the construction sector.

Going into the second half of 2019, the Association points out that high cost of raw materials, and electricity, as well as the current tax regime remain major constraints to growth of local industry.

Consumer Confidence

In contrast, the consumer confidence survey showed a dampened confidence as reflected by a 3.2 percentage point decline in the confidence index to record 96 percent, from a growth of 99.2 percent recorded in June 2019.

The weakened consumer sentiments reflect the latest upward adjustments in utility tariffs.

The Consumer Confidence Survey reflects prevailing consumer sentiments as expressed by households and likely developments in those sentiments for the months ahead.

Composite Index

The growth in the Bank’s updated Composite Index of Economic Activity (CIEA) showed some slight moderation in economic activity.

The CIEA recorded an annual growth of 2.1 percent in July 2019, compared with 4.3 percent in the corresponding period of 2018.

The Governor of the The key drivers of economic activity during the period were private sector credit expansion, contributions to SSNIT by the private sector, port activity, exports, and domestic VAT.

Private sector credit growth has moderated slightly after peaking at 22.1 percent in March 2019 as credit conditions tightened marginally. Annual growth in private sector credit was 13.4 percent in August 2019, compared with 15.8 percent growth in the same period of 2018.

In real terms, private sector credit expanded by 5.2 percent. The recent credit conditions survey indicated some tightening of credit stance on loans to enterprises and households despite increased demand for loans as banks continued to improve their credit risk management systems.

Business News of Thursday, 26 September 2019

Source: goldstreetbusiness.com