The central bank has advocated an increased Public-Private-Partnerships (PPP) in crucial infrastructure development across the country to boost the local manufacturing of key products.

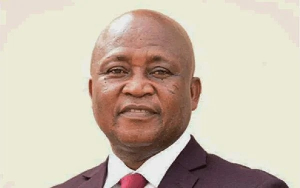

Mrs. Elsie Addo Awadzi, the Second Deputy Governor of Bank of Ghana said: “We need critical public-private sector investments in key infrastructure over the medium-term to increase the manufacturing capacity of our economy post-COVID-19.”

Though the country recorded a positive trade balance in 2018, key imports than continue to put pressure on available foreign exchange include refined petroleum (US$738M), cars (US$466M), rice (US$425M), non-fillet frozen fish (US$303M), and delivery trucks (US$274M).

She said the country needs to re-tool, re-equip and fund the Micro, Small and Medium Enterprises (MSMEs) to leverage technology for increased productivity so that some of the imported item can be made locally and reduce our dependence on imports.

Mrs. Awadzi, was speaking at Engine Business Network (EBN) Micro, Small, and Medium sized Enterprises (MSME) virtual conference on the theme: “MSME manufacturing capabilities, responding to covid-19 and opportunities beyond” in Accra.

She called for a renewed focus on equitable and inclusive growth to ensure that the MSME sector, and in particular, women and youth entrepreneurs were not left behind.

She said the Bank of Ghana has taken steps to improve access to credit for MSMEs through the banks, savings and loans companies, microfinance companies, and rural and community banks.

Mrs. Awadzi encouraged all the MSMEs to approach their financial institutions to explore financing and other opportunities available for them.

“I encourage you also to engage actively with the Ghana Association of Bankers, and industry associations representing the savings and loans companies, microfinance companies, and rural and community banks, to help these institutions better understand the needs of members and to fashion out specific products and services to support you,” she added.

She said the Central Bank was committed to ensuring that policies and regulatory measures help to promote macroeconomic stability and growth, not only for a few, but for all Ghanaians.

She said by promoting monetary and financial stability, “we seek to create an enabling environment that supports all economic players to contribute their fair share to socio-economic development and nation-building.”

She said the Bank of Ghana has recently launched the Ghana Sustainable Banking Principles in partnership with the Ghana Association of Bankers and the Environmental Protection Agency.

These are a set of seven principles adopted by banks in Ghana in November 2019, by which they committed to scaling up lending to five key sectors of the economy in a manner that promotes good environmental management practices and social justice including through gender equity and access to finance for all.

Mrs. Awadzi said while the impact of COVID 19 on the sectors has been severe, there is much hope with the recovery ahead, and there were enormous opportunities in the post-COVID world.

“What is more, policy makers have made interventions to help cushion the impact of the pandemic on the MSME sector,” she said.

Business News of Wednesday, 1 July 2020

Source: thebusiness24online.net