...threatens fines against wayward traders

The Bank of Ghana (BoG) on Wednesday announced fresh measures to curb the spate of widely divergent exchange rate quotations by banks and traders, which have yielded estimates of the cedi’s depreciation at great variance to the central bank’s own figures.

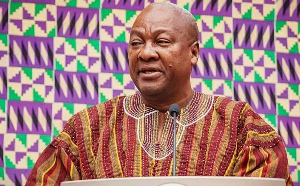

At its latest monetary-policy committee (MPC) press briefing in Accra, Governor Henry Kofi Wampah said the central bank wants to bolster transparency in the foreign exchange market and make it easier to punish wayward dealers that breach the law and a new code of conduct to be launched next week.

Dr. Wampah stated: “In addition to the policy rate decision (the bank held the policy rate at 16 percent for a third straight meeting), the central bank will introduce the following: a new set of foreign exchange regulations and code of conduct to guide operations in the foreign exchange market; a review of the Foreign Exchange Act, 2006 (Act 723) for easy application and enforcement; and a uniform trade reporting platform for all banks to ensure transparency in pricing, price discovery, and online reporting”.

There’s been a wide divergence in the average exchange rate quotations of the cedi by banks, traders, research firms, and the central bank. As a result, the cedi’s rate of depreciation has been variously calculated.

While the BoG reckons that the cedi has lost around 9 percent to the dollar since the year began, Ecobank Research estimates the depreciation at about 19 percent; and Bloomberg, the online business news wire service, quotes the cedi’s losses at 16 percent.

The BoG has said its figure is derived from the weighted average transaction rate of all banks in the country, whereas most private analysts’ estimates are based on quotations from only a few banks. In some cases, the banks providing quotations are not even based in Ghana, and their figures are never used in trading, said Dr. Wampah.

One private analyst told the B&FT he fears banks may be misreporting their trading figures to the BoG, giving the central bank a false picture of the goings-on in the foreign exchange market. He added that on the other hand, some private analysts track banks’ trading in “real-time”, giving them access to the actual quotations used in trading.

But whichever figure is accurate, the large discrepancies have the tendency to send confusing signals to currency traders and the public about the true value or price of the cedi, while some of the more extreme numbers can lead people to form perverse expectations about the cedi’s future performance.

For instance, foreign investors wanting to buy into Ghana’s debt or equity markets would be puzzled by some private researchers’ description of the cedi as the “third-worst performing African currency” against the dollar -- which is in sharp contrast to the central bank’s view that the cedi is stable and its depreciation moderate.

If foreign investors are to believe the private quotations, they are likely to bid for government securities at high yields -- in order to get returns that beat their perception of high cedi depreciation -- and this could potentially raise the cost of borrowing for government.

Dr. Wampah said: “It is because of these divergent rates that we want to introduce transparency in the market. We also want to review the Foreign Exchange Act to create a situation wherein we are allowed to impose fines on those who breach the rules, because now the penalty is suspension from trading -- which is very extreme and affects customers of the banks.”

Business News of Friday, 29 November 2013

Source: B&FT