Total deposits of the banking industry as at the end of February 2017 was GH¢53.2 billion, up from GH¢51.8 in January, representing 33.1 percent increase.

The banking industry also recorded GH¢83.6 billion total assets as of the end of February 2017, up from GH¢81.9 billion recorded in January, representing 33.5 percent annual growth.

Total gross advances were GH¢36 billion, which constituted 19.1 percent of growth.

Non-Performing Loans (NPL) ratio of the banking system, as at the end of February 2017, was 17.7 percent, down from 18 percent recorded in January 2017 while capital adequacy ratio for the banking industry was 18.5 percent, up from 17.8 percent recorded in January 2017.

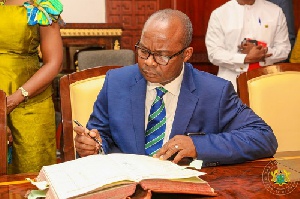

The immediate-past Governor of the Bank of Ghana (BoG), Dr. Abdul Nashiru Issahaku, who was speaking at the last Monetary Policy Committee (MPC) press briefing in Accra recently said, “As government continues to honour its commitment to pay down the restructured energy-related SOEs debts, it is expected that banks’ non-performing loans will decline, with positive implications on the solvency of banks in the coming months.”

Dr. Issahaku said the Bank’s updated Composite Index of Economic Activity (CIEA) recorded an uptick in year-on-year terms.

He said the increase was driven mainly by exports, port activities and private sector credit growth, adding that the consumer and business confidence indices reflected positive sentiments about economic and industry prospects.

Business News of Thursday, 6 April 2017

Source: dailyguideafrica.com