Business News of Friday, 21 June 2019

Source: www.ghanaweb.com

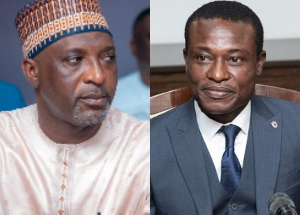

Banking sector cleanup a step in the right direction – Yofi Grant

Chief Executive Officer of the Ghana Investment Promotion Centre (GIPC), Yofi Grant has justified the Bank of Ghana’s decision to sanitise the country’s financial and banking sectors which has led to the merger of a number of local banks and the closure of some insolvent microfinance companies.

Although faced with backlash from the opposition National Democratic Congress and some economists that the cleanup is causing most people to lose their jobs, Yofi Grant said the banking sector cleanup was a step in the right direction.

According to the GIPC CEO, government must be commended because it would have been disastrous if the central bank had not cleansed the system.

“A lot of people say that this government has come to destroy the banking sector, people have lost jobs etc. If they hadn’t done what they did do you know what could have happened by now through to next year?”

“The whole financial system would have collapsed because there’s nothing more bad than an institution taking people’s deposit and using it for their own business and not return the gains of the people who gave them the capital. So government had to sanitize it and make sure that our banks and financial institutions comply with the laws”, he noted.

The recent cleanup of the banking sector by the central bank has seen the reduction of commercial banks from 33 to 23.

The Bank of Ghana last month began its second round of financial sector clean up to close down microfinance companies that were insolvent and facing serious liquidity issues.

About 386 insolvent microfinance and microcredit companies have had their licenses revoked by Bank of Ghana.

The Bank of Ghana backing their decision, explained the move was part of new measures to ensure that existing institutions remain structurally and administratively safe enough to continue with their businesses by complying with its regulations.

According to the central bank, there are currently 37 licensed savings and loans companies operating across the country.