The Bank of Ghana (BoG) has presented vehicles, laptops and printers to a number of umbrella groups in the microfinance industry to support their oversight and supervision roles.

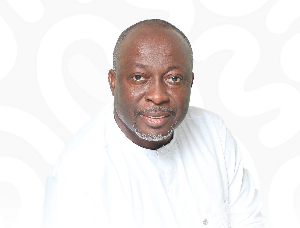

Dr Abdul Nashiru-Issahaku, BoG Second Deputy Governor, said it was the hope of the Bank that the items would assist the umbrella associations of micro-finance institutions to effectively co-ordinate the activities of their members in the coming years.

He reminded the executives of the associations that the items came with expected responsibilities.

Dr Nashiru-Issahaku said some of the responsibilities expected included adequate maintenance of all vehicles and equipment in order to prolong their lifespan and to offer adequate administrative support to members of the association.

The rest were to conduct regular field visits in order to aid the operations of members and continue to educate them on BoG’s policies and regulations.

He recalled that it had been over two years since the BoG took the bold step of regulating and instilling sanity in the microfinance industry in Ghana after witnessing the unbridled and indiscriminate springing up of those institutions throughout the country.

“We have indeed come a long way through consultations and subsequent issuance of licenses to legally subject institutions under the banks supervision. We are aware there are challenges, but as the saying goes, once there is a will, there is certainly a way,” he said.

He observed that, to date, the BoG had issued final licenses to 394 microfinance institutions, consisting of microfinance companies - 344, money lending companies – 45 and financial Non-Governmental Organisations - 5.

He said: “Clearly, the size of the microfinance industry has increased tremendously within a short space of time, and I am informed that more applications have been received for our consideration.”

“As regulators, more resources and logistics are needed for effective regulation and monitoring of institutions. There is no doubt that we find ourselves in a new and unchartered territory as far as the microfinance industry is concerned.”

Dr Nashiru-Issahaku said indeed the BoG was aware of the fact that microfinance regulation was not a simple process, since the industry encompassed a wide array of institutions that provided a variety of services to many different customers.

He said there was, therefore, the need for a balancing act by all stakeholders in protecting customers and maximizing profits whilst promoting financial inclusion.

“It is my firm belief that the partnerships we have developed in this regard will be a lasting and enduring one which will benefit our society by helping to alleviate poverty through microfinance and ultimately spur economic growth and development,” he said.

Business News of Sunday, 9 March 2014

Source: GNA