Business News of Saturday, 11 February 2023

Source: thebftonline.com

Apply tax exemptions sparingly

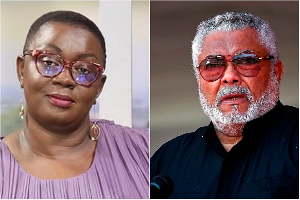

Minority Leader and Ranking Member of the Finance Committee in parliament, Dr. Cassiel Ato Forson, commenced parliamentary duties this week by recommending that a halt be placed on tax waivers to save the economy much-needed revenue in the face of current economic challenges.

The World Bank has advised government to shed some of its tax practices, particularly tax exemptions while increasing efficiency in tax collection. For a country that badly needs revenue to fix its debt-to-GDP ratio, Ghana grants too many tax exemptions.

The economy lost GH¢27billion to tax exemptions between 2008 and 2020, leading to passage of the Tax Exemptions bill last July.

It provides for a tax exemption regime in the country with defined criteria for exemptions, and was expected to save the economy GH¢460million in 2022 according to Minister of Finance Ken Ofori-Atta.

However, as the country faces mounting economic challenges, Ato Forson believes government should halt all forms of tax waivers to companies in a bid to raise additional revenue to support the recovery process.

Given the downturn in economic activity along with rising public expenditure, the Ranking Member of the Finance Committee is confident that such a move would be apt. His remarks were in response to a question regarding public perception about huge sums that the country loses annually through exemptions.

Though the country has saved some funds since passage of the Tax Exemptions bill last year, Dr. Forson notes that there is a need for further scrutiny to identify gaps in the regime and improve on them in order to save more.

Finance Minister Ken Ofori-Atta noted that in 2020 alone about GH¢1.8billion was lost, the worst recorded for a single year since 2008.

Although it is important for Ghana to use tax exemptions for attracting foreign investors into the country, empirical evidence has proven that too many tax exemptions have failed to provide the desired result.

Ghana loses over GH¢5billion every year through tax exemptions, that’s why tax consultant and attorney Ali-Nakyea and Associates urged government to take a second look at the tax exemptions régime if it means to rake in more revenue for the state.

Indeed, the country has chronically struggled to mobilise enough revenue to fund its expenditure requirements. It is therefore proper to explore all the avenues to raise more revenue, and limiting tax exemptions is one such way.