Kongo, a usually quiet town in the Nabdam District, came to a stormy moment last Friday when some frustrated market women scaled the walls of the GN Savings branch in that part of the Upper East region to demand their locked-up savings.

The wall-climbing women were among scores of unhappy customers who poured into the streets with protest placards and laid siege to the secured premises of the bank in strong demand for their investments.

They had set the town’s main market on ‘fire’ with a march through it and had taken to the Bolgatanga-Bawku-Pulmakom Road with displeasure chants before they assembled in their numbers in front of the bank’s block, singing discontent songs as they waited impatiently for answers from the bank’s authorities.

Some of the placards screamed: “We need our money now or suicide!!!”; “GN, be responsible!!” and “Release our pension money now!!!”.

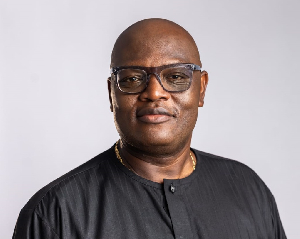

So loud was the outcry, and the furore so threatening, that the bank’s management kept the gates to the compound firmly locked to the protesters. Some armed police officers were on hand to ensure nobody messed up as the demonstrators massed up. Even in the face of the security presence, the Upper East Regional Manager of the GN Savings, George Afari, who came to the scene to calm down nerves, had to park his car at a hidden location kilometres away reportedly out of fear the angry clients could seize or vandalise it.

“The setting up of a branch of GN Bank in Kongo made us believe that the era of keeping monies under beds and mattresses was over. Their agents came in numbers and convinced our poor market women that it was safe and better to deposit their little earnings with them. They convinced us that we will have access to our monies anytime we needed it.

“As we speak today, no customer can boast of being able to withdraw even one Ghana cedi if they walked into the banking hall right now! To further deepen this insult on our efforts, the officers continually lie to us whenever we ask to be assured of a particular period that we can start accessing our deposits. There are people who have passed on without touching their pension payments after many years of work. Some people have attempted suicide because their creditors have arrested them for debts,” said the aggrieved customers in a statement.

The leader of the dissatisfied depositors, Elias Mort, read out the statement to the bank’s authorities who stood behind the locked metal-bar gates.

“Many young people who started small-scale businesses have folded up because they couldn’t access their savings. This season, many farmers who deposited the rewards of their harvests last season with GN Bank cannot plough, plant or buy seeds. Effectively, Kongo may witness food shortage problems next year because majority of the aggrieved customers gathered here are farmers.

“Our demands are simple. GN Savings and Loans should immediately make our deposits accessible to us without further delay. To achieve the above, they should give us a roadmap with clear dates to accessing the locked-up monies. Failure to do the above might lead to fatal consequences for some people and we are sure that Dr Nduom would not like to be tagged negatively for his role in the demise of breadwinners of families,” said the statement.

Breach of Bond as Meltdown causes Letdown

Questions came up as to what led to the protest. From way back, the bond between the investment firm and its clients did not start with protest when the former came to invest.

Along the way, a meltdown led to a letdown. And the ensuing conflict between the collectors and the depositors degenerated into a depth where rage constrained the Upper East Regional Manager of the GN Savings to a ‘cage’ as he addressed the fuming clients from behind the locked iron gates on Friday.

“Last year, the licences of some banks were revoked. The public perception was that all the other local banks were also going to be affected or closed down. As a result, many customers became afraid. So, all the customers were trooping in to withdraw.

“The panic withdrawal seriously affected our liquidity because, as an institution, part of the deposits is invested, part is kept for daily operations. So, because of the panic withdrawal, we exhausted the proportion of the funds that we keep for daily operations. And that is what has affected this. But for now, things are getting better because we are able to meet some of them halfway and we hope that things will get normal as soon as possible and we will continue to serve them better,” Afari explained to the press as the disgruntled crowd vented venoms in the background.

We Want our Monies Now!— Demonstrators Insist

The Regional Manager told the protesters their concerns were being looked into by management and assured them funds would be made available soon to settle them.

But his word was met with a strong grilling from the skeptical crowd who pressed him hard to mention a specific date to expect the promised refund.

“How long?” the demonstrators chorused. The manager, flanked on both sides by his colleague staff, did not reply as he waited for the crowd to disperse. “How soon?” a plump woman followed up immediately, her fleshy right arm shaking from fury as she threw it up in the air and held her wrapper with the other hand. The manager looked like he did not know what more to tell them than had already been said.

“Tell us something concrete!” a yellow-shirted man with a bald head shouted in the sweltering sun, his face looking very sour for his money like he just gulped one litre of lemon juice against his will. “The patience is getting out of hand now. We have been waiting for too long and you have been talking about coming soon, coming soon. This is the time we need the money. This is the season. Tell us the action you are taking as we are standing here!” he added.

The rest of the crowd backed their angry colleague with a roar as he spoke. A woman, dressed in a protest red and black outfit, pulled out a stick and hit an improvised yellow gallon drum loudly and repeatedly as they all cheered their colleague depositor clamouring for refund. He spoke just their minds and he did so with the same tone they would have used.

“Previously, it was difficult accessing some funds,” the manager responded. “Now, funds come in periodically and some of you are able to access funds. And you can attest. Only that we are not able to meet you fully as you request, but we are able to meet you halfway. And it means that things are improving.”

Unsatisfied, the customers drew closer to the gates and hurled tons of harsh words at the financial firm. When the staff walked away, some of the irate women made for the walls and climbed girlishly. And when the police officers restrained them, a number of the protesters left the scene, spewing invectives as they walked along the highway. But some vowed to remain on the premises until their monies were returned.

“They are owing me for more than eight months now. I have a daughter whom I feed and whose school fees I pay. Without the money I can’t do anything. I need my money. If they don’t give me my money, I won’t go home. I will sleep here. I will go and bring my mat. And I will do it!” Becky Anaba, one of the disappointed women spotted lying flat on the bare ground at the gates, told newsmen.

Business News of Sunday, 14 July 2019

Source: starrfm.com.gh