-To engage in Surface mining for more profit

Information gathered reveals that AngloGold Ashanti will shutdown its Obuasi Concession by the end of December this year.

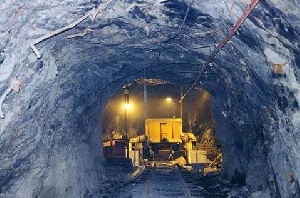

The company is currently considering continuing with its surface mining programme which it regards as profitable against the expensive underground mining it has been doing for some years now. By the end of December this year, workers will be paid their end of service benefits, according to a highly placed source with the mining giant.

When contacted, Mr. John Owusu, Public Affairs Manager of the company noted that the company will not expel 6,500 workers as is being speculated, but refused to give the actual number of workers who will be affected by the redundancy exercise. He said AngloGold Ashanti has secured the services of a consulting firm that is studying the exercise being undertaken by the company, and their final report will determine how many people that will be sacked. He stated that AngloGold Ashanti will continue to operate in Ghana and pay tax to government when necessary.

Over the past 18 months, AngloGold Ashanti has taken decisive steps to adapt to the sharp decline in gold prices and more volatile market conditions. Corporate and exploration costs have more than halved; the company is on track to realise its targeted $500m in annualised operating cost savings by year-end, and capital expenditure has been further rationalised. None of these actions compromised the long-term outlook for the business, and the company continues to invest in the expansion of its Cripple Creek & Victor mine in the US, extending the life of its Mponeng mine in South Africa and supporting a focused, high-quality project and exploration portfolio.

Tragically, one-employee fatality was recorded at the Mponeng Project in South Africa, and two-contractor fatalities occurred at the vent shaft at the Cuiabá Mine in Brazil. The company remains committed to eliminating fatalities at its mines through sustained and focused safety interventions, which last year resulted in a 50% reduction in fatal incidents and enabled 80% of operations to set new safety records. The first-quarter All Injury Frequency Rate of 7.76 is the best first-quarter performance on record.

At the Obuasi mine in Ghana, AngloGold Ashanti has progressed a range of interventions to address historic underperformance and the high-cost structure, but substantial further work is required to establish a sustainable future for the mine.

Commenting on these initiatives, Venkat said “we have now developed a good working partnership with the Government of Ghana, the Ghana Mineworkers Union and other key stakeholders to address the challenges facing Obuasi. We must do all we can to stop the current cash outflows at Obuasi and define a sustainable future – and we appreciate the support of our partners in taking the decisive action necessary to achieve this.”

AngloGold Ashanti’s net debt declined modestly to $3.095b, signaling that the company generated positive free cash flow.

Chief Financial Officer Richard Duffy commented: “As the business moves to positive free cash flow generation and given the current uncertain gold price environment, we remain focused on our financial flexibility. Overall debt levels and interest burden remain high relative to historic levels, but we have made good progress to pro-actively diversify our funding sources and extend our maturity profile.”

Business News of Wednesday, 23 July 2014

Source: Adu Koranteng

AngloGold Ashanti closes Obuasi mine in December

Entertainment