Nkechi Akunyili, Managing Partner of Access View Africa, a portfolio investment and advisory firm, has predicted a positive outlook for the Ghana cedi on the back of expected bond issuances, positive forex inflows from crude and gold export and the attractiveness of the economy to foreign direct investments.

She forecasts a 3.9percent depreciation this year for the worst scenario but adds that sustaining the gains of the local currency will be largely hinged on government’s ability to shore up import substitution by leveraging the Africa Continental Free Trade Area (AfCFTA).

“A country’s currency is as good as its economy; there is a positive outlook for the stability of the cedi but we can do better with increased exports.

With the AfCTFA, we should be looking at the productive sectors to facilitate import substitution. We change dollars to import; we flip it to the other side and the cedi will stabilise,” she said as a panelist on Azafinance’s webinar on Ghana in recovery: outlook for growth, AfCFTA and the cedi.

The webinar discussed the fortunes of a pandemic-laden Ghanaian economy highlighting how the single continental market will fast-track its recovery to growth and also how the use of the dollar for AfCFTA-borne transactions will impact the cedi.

To Ms. Akunyili, the AfCFTA will facilitate trade but making settlements in the dollar, for instance, cannot help the pressure on the respective currencies of member countries.

She admitted that the continental market hoards huge prospects for Ghana and all other countries that are signed onto but advised that payments for trade must be in local currencies.

“Trade between two African countries can be measured against the dollar but settlement should be in local currencies,” she noted.

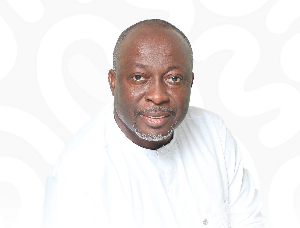

Another panelist and Executive Managing Director of AfCFTA Policy Network Ghana, Louis Yaw Afful, indicated the need for a solid pan-African payment system as a boost to integrating trade across the continent.

He therefore tasked tech start-ups and fin-techs to study the African terrain and come up with digital platforms that will facilitate trade.

He said: “AfCFTA has come to boost intra-trade and to integrate cross-border trade; it’s a gamechanger but steadily.

E-commerce is one critical area that holds huge prospect for the market and its subscribers.”

Business News of Wednesday, 17 March 2021

Source: thebusiness24.com.gh

Analyst predicts positive outlook for cedi pinned to exports

Entertainment