A group of American companies with major investments in Ghana have joined forces to launch an organization to promote improved bilateral ties. Charter members of the U.S. Ghana Economic Council include Coca-Cola, Newmont Mining, Lehman Brothers, CMS Energy and Cargill.

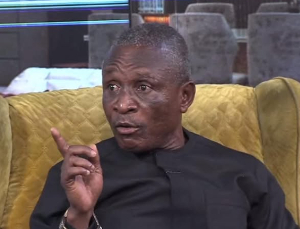

"When I was appointed to Washington, I promised the president I would take relations to another level," Alan Kyerematen, Ghana's ambassador to the United States told a reception to launch the Council earlier this month, "This is an important step in that direction," he added. Last week, in a major government reshuffle, Ghanaian President John Kufuor appointed Kyerematen to his Cabinet as minister of trade, industry and special presidential initiatives.

Speaking for the reception sponsor, Curt Ferguson, senior regional manager for Coca-Cola in West Africa, spoke glowingly of an improved investment climate in Ghana, which he said has been undergoing an "amazing transformation." Coca-Cola, he said, has been growing at 15 percent a year in the country.

"Newmont is new to Ghana," said Durand Eppler, a vice president of the Denver based firm, one of the largest gold mining companies in the world. "We welcome the opportunity the Council offers to interact formally and informally," both with other businesses operating there and with the government, he said in an interview.

Earlier this year, Newmont announced plans to invest $450 in two Ghana mines over the next three to four years. When completed, the project would essentially double the current level of American investment in the country. A report in the Ghanaian Chronicle said the new mines could result in 900 new jobs and an estimated $1.5 billion for the economy.

Newmont's announcement followed a decision by the government to allow mining for the first time in previously protected areas. "Ghana has thrown the door open to mining companies wanting to mine gold in the country's environmentally sensitive forests," the online newsletter Mineweb reported last month. Ghana is Africa's second largest gold producer after South Africa, and gold accounts for about 40 percent of the country's foreign exchange.

CMS Energy, which is headquartered in Dearborn, Michigan and is already one of the largest U.S. investors in Ghana, also plans a major new investment -- a $100 million expansion and upgrade of a thermal power plant at Takoradi in which the company owns a 90 percent stake. The other 10 percent is held by the parastatal Volta River Authority.

George Pickart, who represents the company in Washington, says CMS Energy welcomes formation of the new Economic Council. "We have been impressed by the progress the government has made in consolidating democracy and reforming economic policy, including significant changes in the energy sector where we operate," he said.

The upgrade CMS Energy is planning would convert the plant from a current dependence on burning crude oil to natural gas, a cleaner and cost-efficient alternative. The converted facility would be the anchor customer for the planned West African pipeline, which will transport gas produced by Nigeria's oil wells to Ghana and two of its neighbors, Togo and Benin. The gas is currently being flared at the Nigerian fields.

Gas is projected to begin flowing through the 350-mile pipeline in mid-2005, reducing both pollution and energy costs. The upgrade, which will add a third power-generating plant alongside the existing two facilities, is expected to produce one-third more electricity about one-third more cheaply, without using any additional fuel.

According to Ambassador Kyerematen, the Council is designed to "offer personalized, targeted and results-oriented services to members." Among the services he foresees are video conferences to provide members with an efficient means to hold discussions with Ghana business and government leaders, cutting down on the needs for travel and thereby saving members time and money.

Ghana is one of the first African countries to set up a business membership body in the United States. "U.S. business ties with Ghana have now reached a point where an organization of this type can be sustainable, " said Kevin Callwood, a former official at the State Department and Overseas Private Investment Corporation who helped found the Corporate Council on Africa a decade ago and has been working with the Ghana Embassy on creating the new group. Other similar organizations include the U.S. Angola Chamber of Commerce and the U.S.-South Africa Business Council.

Included on the Council's proposed agenda are internships for outstanding Ghanaian and American graduate and undergraduate students with public, private and non-governmental institutions in the United States and Ghana, as well as a fellows program to allow mid-career Americans to spend up to a year working in the private sector in Ghana.

Other planned activities include high-level briefings from Ghana government officials and collaboration with government agencies and private groups on trade missions and industry fairs and expositions. The Council will raise funds from membership fees and an annual Kofi Annan Leadership Dinner, in honor of the United Nations Secretary General, a Ghanaian.

According to Kyerematen, the Ghana Council could also play an important role in "helping to resolve any disputes" between member firms and the government in Ghana. One State Department official involved in Ghana policymaking called that promise "music to everyone's ears."

Standoffs between Ghana and two American companies are currently complicating an otherwise warm bilateral relationship, the official said. One disagreement involves Westel, a subsidiary of Western Wireless located in Bellevue, Washington, which won the license to become Ghana's second national phone company, after the government-owned Ghana Telecom.

The government says Westel is in default of its obligations because it has not installed 50,000 new phone lines, as the license stipulates. For its part, Westel says its ability to operate have been hampered by regulators and Ghana Telecom, making it impossible to reach the agreed targets.

A more far-reaching dispute involves Kaiser Aluminum, which owns 90 percent of the Volta Aluminum Company (Valco) and is at loggerheads with the government over the price and availability of the electricity that Valco needs to operate its smelter at Tema. Ghanaian officials say Kaiser refuses to agree to a fair rate for the power. Valco has been paying 1.1 U.S. cents per kilowatt-hour, while the cost of producing electricity in the country has risen above six cents. Kaiser disputes the government's cost calculation and says the price Ghana wants would push the cost of producing aluminum above the world market price.

Also at issue is the 50-year Master Agreement signed in 1962, when Kaiser Aluminum began operations in Ghana. The government argues that the Power Contract contained in the Agreement has expired and that renewal is subject to Parliamentary approval.

An effort to end the impasse with mediation failed earlier this year, and Kaiser has taken its case to the International Chamber of Commerce for arbitration. Kaiser Aluminum, which is currently in bankruptcy, has also sought backing in Washington, DC. "This is taking a lot of high-level time - at Treasury, State, Commerce and the USTR (the office of U.S. Trade Representative Robert Zoellick)," said one official directly involved in the interagency discussions.

To pressure the Ghanaian government to settle with Kaiser, the Overseas Private Investment Corporation (Opic), a government agency that makes loans and loan guarantees to support American investments abroad, has put a hold on its activities in the country.

"The government of Ghana is aware of the seriousness with which we regard this issue," said the administration official, speaking on condition of anonymity. "They have heard from top officials in this administration, and they know we want to see this settled," the official said. "In other areas, from macro-economic policies to regional security, we are pleased with the direction President Kufuor has taken."

One result of the freeze on lending to Ghana by Opic has been to delay CMS Energy's power plant upgrade and expansion, for which Opic financing is expected. Ironically, completion of the new power plant would lower the cost of electricity significantly, a core issue in the dispute between Kaiser Aluminum and the government.

Kyerematen, the outgoing ambassador, says Ghana does not deserve this treatment. "It is very unfair," he said in an interview. "This situation needs to be resolved so we can move forward."

Business News of Wednesday, 2 April 2003

Source: allAfrica