ndigenous banks which failed to recapitalize before the Bank of Ghana’s 2012 December deadline, have all complied accordingly.

This means that any bank that intends to enter Ghana’s financial market would be expected to raise a minimum capital requirement of at least GH¢100 million.

All banks in the country were expected to meet the GH¢60 million recapitalization requirement before the deadline.

The Central Bank, which revealed this recently to journalists in Accra, said the banks would not forfeit their licenses since almost all of them have met the BoG’s cut-off date.

Few weeks to the December deadline, the central bank stated that four banks had not meet the GH¢60 million recapitalization requirement.

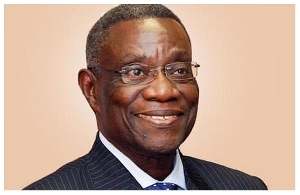

Last year, when efforts by some banks to single-handedly raise the capital required failed to yield any results, industry captains including Alhassan Andani, Managing Director of Stanbic Bank Ghana, called for consolidation in the banking industry.

According to him, that was necessary to promote strong capital and technology since Ghana had discovered oil in commercial quantities.

“This is realized from closing down overlapping branches, laying off idle staff and disposing of unwanted capital goods.

During such times, revenue increases are realised especially when various products of the different merged banks are taken up for sale from branches of merged banks.”

Furthermore, he said consolidation helps banks to undertake syndication of loans.

Business News of Thursday, 10 January 2013

Source: Daily Guide