African Financial Group (AFG) and International Equity Fund Castlepines Corporation have announced a partnership that will result in the two companies investing in large-scale infrastructure and mining projects in sub-Saharan Africa.

The Johannesburg-headquartered AFG is a diversified Pan-African investment company with interests in a wide range of sectors including healthcare, financial services, resources and infrastructure.

Castlepines Corporation, headquartered in London, is a pre-eminent global equity fund that invests its own and partner equity in major assets in sectors ranging from mining and resources, power generation and utilities to real estate and shipping and marine.

“The partnership we have established with Castlepines Corporation will give AFG the muscle to participate in big infrastructure and mining investments in key African markets,” said AFG chairman Dr Gil Mahlati.

“Castlepines has access to a large pool of capital from Western pension funds, which are looking for better returns in emerging markets than they can get in their home markets. Since Africa is one of the fastest growing regions in the world, Castlepines is now in a market that can generate healthy returns for its investors and partners.”

Dr Mahlati said AFG and Castlepines Corporation have already hit the ground running and have identified investment opportunities in the social infrastructure space, where they are looking to deploy cash in the planned construction of government hospitals, housing for civil service workers, and buildings to accommodate students.

Over the next five years, the South African government is planning to spend R250 billion on housing, R75 billion on student accommodation, and R20 billion on hospitals.

“There are also 100 black licencees who are looking to raise money to build new private hospitals. AFG and Castlepines will also explore this investment opportunity as there is a huge backlog in the provision of healthcare infrastructure and services in South Africa,” said Dr Mahlati. David Grose, founding partner and CEO of Castlepines Corporation, is thrilled that the international equity fund is bringing low-cost, long-term, all-equity funding to Africa, which could be used to drive development and boost economic growth on the continent.

“In AFG we have chosen a partner with excellent expertise and track record that understands the local markets. Together, we will work closely to identify projects that we will jointly invest in. “We are polite passive investors bringing cheap Western capital to the developing world. The key to any Castlepines investment is ensuring that the return or coupon on the equity that we and our partner pension funds have contributed is secure, date-certain and sum-certain for the full investment term, and that the asset is investment grade,” Grose said. Grose explained that the key elements of Castlepines’ investment strategy are:

•Investing in assets with a purchase price typically greater than $100 million or equivalent in local currency;

•Assets leased by a strong entity for the investment term, normally 20 years and longer. Shorter terms are possible but require a higher yield. Assets are leased under a triple net lease structure or a bareboat charter basis for shipping. Alternatively, the assets can be operated under operations and maintenance, and off-take contracts for the investment term; and

•An agreed annual inflationary increase on coupon payments (commonly 3%). “We don’t invest in underground mining, where there is a huge risk of people being hurt. We invest in surface mining only and any form of infrastructure as long as it does not lead to environmental ugliness.

“We like investing in projects that do not harm the environment, but create jobs and improve people’s lives. If you invest in a business that cuts trees, please just replant the trees,” Grove said.

AFG was founded established in 2001 at the dawn of the first decade of African economic growth in the ‘African Century”. The initial focus was deal structuring and financing in the health sector.

This was influenced by the founder Dr Gil Mahlati, a medical specialist (surgeon), and activist (having been part of the National Medical and Dental Association, NAMDA, pre-1994).

AFG created a platform for innovative concept development with a transformation focus. This has resulted in investments and participation in listed entities such as Aspen, Cipla, and Netcare, as well as unlisted investments in healthcare and financial services.

AFG’s progressive organic growth was built on collective family effort and strength. Today it is positioned as an innovative finance facilitator with global strategic partners.

Business News of Friday, 17 November 2017

Source: Prosper Agbenyega

AFG and Castlepines Corporation to co-invest in African projects

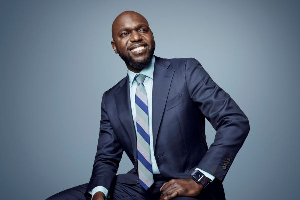

AFG Chairman, Dr Gil Mahlati

AFG Chairman, Dr Gil Mahlati