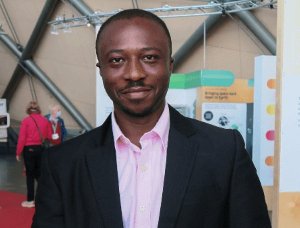

Founder of policy think tank IMANI Ghana Franklin Cudjoe has revealed that a large number of Africans prefer not to invest in Africa or their home countries.

He attributed the reasons to the fact that governments were milking businesses with huge and numerous taxes which serve as a disincentive to well-meaning people who wish to invest in viable ventures.

According to him, the bad nature of politicians and other individuals to run down their colleagues should be discarded as it does not help in the development of a nation.

Mr Cudjoe told Roderick Nii-Lante Wellington, host of Closing Bell on Class 91.3fm Wednesday May 4, that the fact that people are not investing in the country was “totally true and it starts with the leaders [who flaunt] gold-plated Mercedes [and purchase] houses [and other properties] outside of the country; I do not know about Mahama, but I know for others”.

He pointed out that it was the same reasons that “Nigeria is now chasing billions that have been stashed away”.

He further explained that: “Forty per cent of Africans do not invest in Africa because they are scared that it will be misappropriated by the state through taxes or as it were [they will] be witch-hunted. The people leading that charge are the leaders, not the individuals. Individuals outside of Africa are returning value, they are sending so much money in remittances, much more than the FDIs [Foreign Direct Investments] as well. What needs to change is the politics of the day and institutions that need to accept these investments.”

He continued: “Why would I want to invest here [in Ghana] when I have to cough up with a partner about $200,000 before GIPC [Ghana Investment Promotion Centre] will give me a licence? That is not on. In Hong Kong, about 11 years ago, my friends and I were able to set up a business in one hour with $25. That is the way to organise society; people should be able to set up businesses in this country with $50,000 or even $30,000 without all the taxes coming up at them.

The 2016 World Bank Doing Business (DB) Report indicates that Ghanaian businesses make 33 different tax payments a year, spend 224 hours a year filing, preparing, and paying taxes amounting to 32.70 per cent of profits.

Business News of Thursday, 5 May 2016

Source: classfmonline.com