Gbege don dey wan start sake of di sale of Agip oil company to Oando Plc.

Di umbrella union wey dey protect workers for Nigeria oil sector don enta di mata.

Di petroleum and natural gas senior staff association of Nigeria (Pengassan) shutdown di main office of Agip for Port Harcourt, di Rivers state capital for South South.

On Monday Oando Plc say dem don reach agreement wit Eni on di acquisition of a 100 percent stake in dia subsidiary — Nigerian Agip Oil Company (NAOC) Limited.

For statement wey di company release, dem say di completion of di transaction dey subject to ministerial consent and oda required regulatory approvals.

If e happun di transaction go expand Oando current participating interests in oil mining leases (OMLs) 60, 61, 62, and 63, from 20 percent to 40 percent.

Inside all diz tins wey dey happun make di union threaten to withdraw dia members from all offices and field locations over di sale.

Comrade Eyong Survival, wey be branch chairman of Agip group Pengassan Port Harcourt say dem neva understand di kain business wey Agip and Oando do.

E say di union bin meet wit di company management wen dem hear tori of di sale but di managing director deny am – now di tori don become reality.

"Di managing director of Eni Nigeria, Fabrizio Bolondi bin invite di workforce to a meeting on 4 September 2023 and just tell us say Eni don sell dia 20% equity shares in NAOC JV without any regard to outstanding financial obligations to workers, including dia employee savings plan, pension and gratuity.

E dey very important to note say di union wey be di workers representative bin no get any prior information before di commencement of di sales agreement," e tok.

'Over 300 job loss fit happun'

Eyong say, "instead of di MD to tell dem how di sale go affect dia work, e dey go make presentations on planned injection of IPP phase 2 generated power to national grid as well as possible conversion of OPL 245 to OML by di goment."

E say if dem no handle di transaction well, pressure fit dey on di labour market becos of pipo wey fit lose dia jobs.

Di Pengassan oga say over three thousand indigenous workers fit dey out of work.

E add say at di moment a lot of Agip workers don suddenly develop some health challenges sake of di announcement.

"Di Union don order a total withdrawal of her members from all offices and field locations of di company until dem reach a proper agreement wit Eni Nigeria and Agip group Pengassan.

By dat withdrawal action, gas supply to Indorama dey affected, daily oil production on 30,000nbbls of crude oil dey suspended, and about 10mscf of LNG gas to NLNG dey cut-off and about 350MW of Okpai IPP power to di national grid dey shutdown".

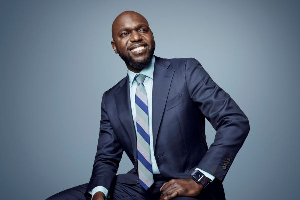

But on di contrary di Group Chief Executive of Oando Plc, Wale Tinubu say plenty tins dey to gain from di multibillion dollars transaction.

E say part of di prospects dey in line wit dia strategy to acquire, enhance, appraise and efficiently develop reserves.

Oga Tinubu add say dis announcement no just be one important milestone for di future of Oando - e also consider di important role indigenous actors go play for di future of di Nigerian upstream sector.

"Di synergy wey dis acquisition don create go unlock unparalleled opportunities for us to re-align expectations, enhance efficiency, optimize resource allocation, and significantly increase production."

Nigeria dey rely on oil as dia main source of money wey dey determine dia foreign exchange.

Though Oando don buy Agip, di Italian group go still keep dia offshore activities in Nigeria, Reuters report.

Wit dis deal on di Nigerian unit Agip Oil Company Ltd (NAOC), Eni don take anoda step in long-term strategy to reduce oil exposure in favour of natural gas sake of wetin happun for Congo Republic in June.

Dis na di latest move out of Nigeria onshore sector by an international oil major.

Nearly all of di big oil companies, notably Shell and Exxon Mobil Corp also get future plans to also sell dia assets sake of serious cases of oil theft, oil spills, clash wit indigenous communities and more focused exploration budgets.

BBC Pidgin of Tuesday, 5 September 2023

Source: BBC

Buying of Agip by Oando Plc don dey cause gbege

Entertainment