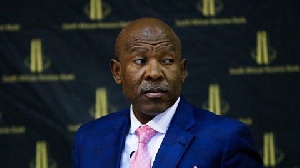

South Africa would be keen to utilise new European Central Bank repo lines if available, the country's central bank head Lesetja Kganyago said on Saturday, adding that his country's interest-rate-cutting cycle still had some way to go.

ECB President Christine Lagarde said this week the bank was planning to make its repo liquidity lines cheaper and easier to access in an effort to boost the euro's international role. The repo lines allow foreign central banks to borrow euros against collateral denominated in the single currency and are designed for times of crisis.

South Africa's veteran central bank head Kganyago said his country would benefit from the lines, given the vast amount of trade and investment that comes from Europe.

"To the extent that you'd have a repo line with the ECB, that would help to underpin that trade," Kganyago said in an interview on the sidelines of the Warwick Economics Summit in Coventry, England. "It would be a welcome development."

CENTRAL BANK WATCHING FOR SLOWING INFLATION

On South Africa's own interest rates, he said last month's decision to keep them at 6.75% meant they were "still distant from the terminal rate."

Policymakers want to see inflation slow further before it starts moving again, but their current projection is for two more 25-basis-point rate cuts this year, plus another next year.

"This forecast of the rate path is not a policy commitment, it's a guideline that changes from meeting to meeting," Kganyago said.

One of the things that has helped drive inflation down over the last year has been the sharp rise of the rand.

That has only started to falter in recent weeks amid jittery global markets, including gold, of which South Africa is a major producer. But Kganyago sees little issue, viewing the broader rise as an acknowledgement of improvements in economic policies.

"What is also important to note here is that the volatility of the currency has declined. The rand used to be a very volatile currency."

BUILDING BRICS

Kganyago, in his third term as governor, also talked about the "weaponisation" of the international financial system.

He stressed emerging market economies were not engaged in any deliberate attempt to dethrone the U.S. dollar, but are looking to protect themselves from the kind of treatment Russia saw when it was cut off from critical financial plumbing such as the SWIFT messaging system.

Access to dollar channels is clearly "a privilege, not a right," Kganyago said, but stressed the dollar would remain dominant and that he sees little prospect of a BRICS currency.

It is an idea floated by Russia and Brazil and is expected to be a topic of discussion when India hosts the BRICS summit later this year, despite U.S. President Donald Trump threatening 100% tariffs on any nation that joins it.

"I do not see how they (BRICS countries) do it without a BRICS central bank," Kganyago said.

He also said South Africa's currency reserves composition — roughly 60% in dollars at the moment — reflected trade patterns and will not change unless those flows shift.

The true motivation for fast‑payment system interoperability, he argued, is reducing the high cost and friction of cross‑border payments, especially in Africa, where non‑convertibility forces trade to be invoiced in dollars through multi‑bank chains.

Africa News of Saturday, 7 February 2026

Source: reuters.com