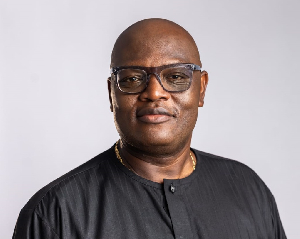

Janade du Plessis is the co-founder of Launch Africa Ventures and Five35 Ventures, two venture firms that have invested in multiple startups across Africa. The founding of the companies was influenced by his childhood memories of seeing his mother and other women running businesses.

“I come from a family of female entrepreneurs, so the first six years of my life before school, all I saw was hustle and women running businesses. They always went somewhere and came back really tired afterwards. My mom was hustling to feed the family, my aunt had a bakery…the women were doing things in their communities. This was stuff I learned from a young age,” he told Forbes Africa.

Those experiences also ushered him into entrepreneurship at a very young age. He taught himself how to make things and sell them. He also sold vegetables, peanuts, and raisins to the community. For the South African entrepreneur, these were baby steps into entrepreneurship and learning the basics of cost management.

“I always saw my mother struggle as an entrepreneur. Had the environment been ready, she would have been a fantastic leader in a big organization, but she never got the opportunity…That is why I am so deeply passionate about investing in women.”

Launch Africa is an early-stage pan-African venture capital fund and has invested in 133 startups in 22 African countries closing over $36 million in its first round. Five35 Ventures, on the other hand, is a pan-African female-focused VC fund investing in Africa’s female tech founders. It has completed 18 investments, according to Forbes.

Prior to starting Launch Africa, Du Plessis spent 18 years in the corporate world including working at the African Development Bank (AfDB) in Nigeria and Rand Merchant Bank (RMB) in South Africa. After his post-graduate diploma in Actuarial Science from the University of Cape Town, he worked as a corporate finance analyst in Johannesburg for Standard Bank. He was on the trading desk and then in the mergers and acquisitions (M&A) team.

Africa News of Monday, 4 September 2023

Source: face2faceafrica.com