In line with efforts to support the Bank of Ghana (BoG) to make Ghana a cashless economy, UniBank has introduced an innovative mobile banking product for its customers and the public.

The new product, Uni-Mobile is a mobile commerce service designed in partnership with Airtel Mobile Money and Star Micro Insurance Services Limited.

It allows customers to make payment and undertake other financial transactions through their mobile phones.

Uni-Mobile provides mobile phone users the opportunity to make electronic banking and payments.

These include deposit of cash into uniBank Savings or Current accounts, transfer of money to and from the Uni-Mobile saving account known as the e-wallet and cash withdrawals.

Users can also pay bills and top-up their mobile credits and as well as make payment to some merchants who would be rolled on the platform soon.

For now, the service can be used by subscribers of Airtel mobile network who use all kinds of mobile handsets.

There is no charge for opening the account, and the product is expected to bring banking services to the doorsteps of both the banked and the unbanked.

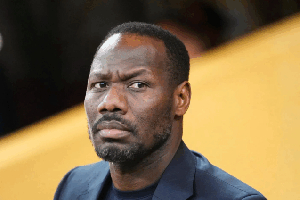

Before launching the new product at the UniBank head office in Accra, Owusu-Ansah Awere, Executive Director of UniBank, said the move is in line with the bank’s vision of offering comprehensive financial solutions to its customers.

He said the bank employs professionalism in a responsive way, adding, “With our tagline – caring for you, we always believe in going the extra mile to ensure that our clients are given the desired service through innovative banking,” said the Executive Director.

To subscribe to the product, potential customers have to undertake three simple steps including activating an account on their registered Airtel SIM by changing their Airtel Money default PIN, sending the word ‘uniBank’ via SMS to the short code 3131 after which they would receive a confirmatory message.

“Our dedicated UniBank Center executives will do a follow up call to complete the process.”

However, existing UniBank account holders, who wish to sign onto the new product, are excepted to visit any of the bank’s branches to fill an account linking form to enable the bank perform the necessary processes.

Apart from the convenience Uni-Mobile provides customers chance to gain a free life insurance policy for account holders and their next of kin, earn monthly interest on total deposit on the accounts and for accounts deposits above GH¢100.

The account holder would enjoy a free National Health Insurance Annual renewal.

Kola Sonola, a representative of Airtel, which has over 1500 outlets across the country, was happy that his company was partnering UniBank to provide banking services to the unbanked.

“People can enjoying banking and engage in other activities without necessarily traveling to the bank but through the mobile phones to access money.”

Gilbert Otto Ossie Alomele, Head of Product Development at UniBank, noted that the service is not only for customers of the bank but anyone who has a mobile phone.

Monies deposited on the phone, he explained, could be accessed anytime and anywhere.

Business News of Friday, 16 March 2012

Source: Daily Guide