Business News of Tuesday, 21 April 2020

Source: thebusiness24online.com

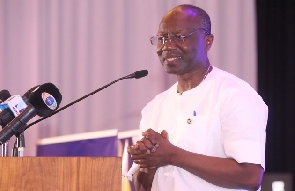

Ofori-Atta to suspend 5% fiscal rule

Finance Minister Ken Ofori-Atta has told the International Monetary Fund (IMF) government is looking to suspend the statutory fiscal rule which requires that the budget deficit in any given year does not exceed 5 percent of GDP.

The Fiscal Responsibility Act, the landmark legislation passed in December 2018, four months before Ghana exited its four-year protracted IMF bailout programme, was intended to safeguard the gains the country had made in achieving macroeconomic stability.

But with the novel coronavirus tearing through the country’s still fragile economy and hurting government revenues like no other crisis has done in the last 40 years, Mr. Ofori-Atta is expected to tell parliamentarians in the coming weeks that the 5 percent deficit rule is a luxury government cannot afford at this time.

The pandemic in one fell swoop has chopped off US$1 billion from government’s expected crude oil revenue, while the imposition of restrictions on human movement to check the virus’s spread has brought businesses to a standstill, with non-oil tax revenues projected to fall by US$400 million.

Apart from the revenue loss, government’s plan of raising enough funds to deal decisively with the pandemic is expected to push the deficit far beyond the 4.7 percent of GDP announced in the 2020 budget.

Mr. Ofori-Atta, who last week received US$1 billion from the IMF to battle the effects of the COVID-19 outbreak, has put all his cards on the table in a bid to overcome the crisis, including suspension of the fiscal rule, given the precarious position of the economy.

The Fiscal Responsibility Act provides grounds for which the deficit rule can be suspended—this includes during a public health epidemic or an unanticipated severe economic shock. The act also stipulates that government present to Parliament, within 30 days of suspending the fiscal rule, plans to restore public finances after the emergency.

Mr. Ofori-Atta is expected to rely on this provision to temporarily set aside the deficit rule, which will enable him to present plans for a revised budget deficit target of 6.6 percent of GDP.

Thread cautiously

While the immediate benefit of the suspension is to create enough fiscal space for government to attempt to reboot the economy, Dr. Said Boakye, an economist with fiscal policy think tank Institute for Fiscal Studies (IFS), is urging the government to be minded about overindulgence.

According to Dr. Boakye, suspending the fiscal rule is the most plausible thing to do now; however, the Finance Minister must ensure fiscal prudence at all times in order not to risk exacerbating the macroeconomic situation.

He argued that with 2020 being an election year, the government needs to tame its appetite to spend and focus solely on areas that will help the country overcome the COVID-19 outbreak.

public debt

Courage Martey, an economist with investment-banking firm Databank, commenting on the immediate implication of the suspension, argued that a wider deficit would herald an increase in the public debt, which stood at GH?218 billion (63 per cent of GDP) as at last year.

He, however, urged that government explores more concessional financing options, like those offered by the Bretton Woods institutions, which are relatively cheaper to service and would not unduly worsen the country’s debt situation.

Mr. Martey said in order for the government to restore the macroeconomic fundamentals to the pre-COVID-19 state, the fiscal rule must be restored as soon as it is possible, as the longer a wide deficit persists, the more difficult it would be to restore the economy to a sound footing.