Business News of Monday, 19 October 2020

Source: NIC

Coronavirus: Take advantage of risk management opportunities - NIC to insurance firms

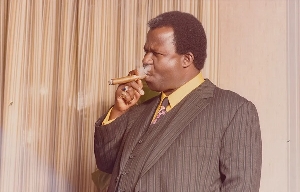

The Commissioner of Insurance, Mr Justice Ofori, has advised Chief Executive Officers (CEOs) and Chief Finance Officers (CFOs) of insurance companies in the country to take advantage of the risk management opportunities occasioned by the emergence of the COVID-19 pandemic.

According to the commissioner, these include the development of new products to meet the demands of the era as this will help them weather the storm against any unforeseen risks that may rear their ugly heads in the future.

Interacting with the top level Management of the country’s insurance industry at a capacity-building workshop organised for CEOs and CFOs of insurance companies, Mr. Ofori urged the participants to also pay particular attention to their financials in order to grow their business operations.

CEOs and CFOs of insurance companies were educated by seasoned insurance practitioners among others in various subjects during the 5-day workshop on how to handle business operations in the face of the pandemic.

Impact of COVID-19

Speaking on the effect of the COVID-19 pandemic on the insurance industry, Mr Ofori advised that, insurers should engage their clients in question-and-answer sessions regularly, as this will enable them know the prudence or otherwise of the risks they are accepting. This approach, he added, will also engender trust between the insurers and their clients.

Touching on the minimum capital, the Commissioner used the occasion to encourage companies to consider mergers as a strategy for struggling companies especially as the deadline to meeting the minimum capital of GH¢50million (i.e. for direct underwriters) fast approaches.

Minimum Capital Requirement

The announcement of the new minimum capital requirements (MCR) in June 2019 has provided the opportunity to insurance entities to adequately prepare to recapitalize by the June 30, 2021 deadline.

The new MCR is with the view to improving the operational efficiency and financial capacity of regulated entities to improve retention and profitability which will naturally culminate into prompt claims payment thus inspiring confidence amongst members of the insuring public. Mergers and acquisitions are possible strategic decisions that insurers may have to take in order to meet the new requirements.