Business News of Saturday, 17 August 2019

Source: ghanaguardian.com

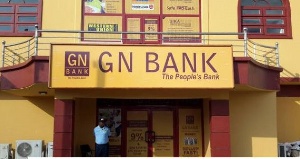

Over 1500 workers of GN Savings and Loans to be jobless

Over 1,500 workers of troubled GN Bank are to be looking over their shoulders for where their next job will be coming as the bank's license has been revoked by the bank of Ghana.

GN savings and loans as they were known before the revoking of license is part of a number of savings and loans that were shut down by the bank of Ghana.

The financial institution owned by the flagbearer of the Progressive Peoples Party (PPP) has over seventy (70) branches with a staff strength of more than 1500 workers.

According to the BoG, GN Savings and Loans Company Limited was originally incorporated as First National Savings and Loans (FNSL) Company Limited and licensed as a Savings and Loans Company on 8th May 2006. It was subsequently issued with a universal banking license by the Bank of Ghana on 4th September 2014 and was renamed GN Bank Limited.

On 4th January 2019, the Bank of Ghana approved a request to reclassify GN Bank from a universal bank to a Savings and Loans company following its inability to meet new required minimum paid-up capital of GH¢ 400 million by 31st December 2018. The reclassification was to among other things enable the institution to downsize its operations and also inject additional capital to resolve the acute liquidity challenges it was confronted with. The Bank of Ghana subsequently appointed an Advisor to GN to assist in the reclassification process.

In spite of the above, the institution has been unable to resolve its liquidity crisis and has also not been able to meet the majority of the conditions the Bank of Ghana imposed on the institution following its reclassification as a savings and loans company. The financial condition of the institution has also deteriorated since the reclassification with both negative capital adequacy ratio and negative net worth.

The Bank of Ghana has reached the conclusion that GN is currently insolvent under section 123 (4) of the Banks and SDIs Act, 2016 (Act 930), being in breach of its key prudential regulatory requirements. Its Capital Adequacy Ratio (CAR) is currently -61%, in breach of the minimum required of 13%. It is also facing a severe liquidity crisis with numerous complaints received by the Financial Stability Department of the Bank of Ghana from aggrieved customers who have been unable to access their deposits with the institution for the last several months. What is more, it has consistently failed to meet the minimum cash reserve requirement of 10% of its total deposits, since the end of the first quarter of 2019.