Business News of Tuesday, 22 August 2017

Source: classfmonline.com

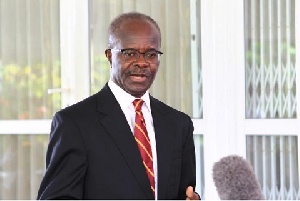

UT, Capital collapse ‘unfortunate’ – Nduom

Business consultant, Dr Papa Kwesi Nduom, has expressed sadness over the collapse of the Capital and UT banks which were setup by Ghanaians.

“… It is not good to see. I want to see indigenous banks thrive because in any country where indigenous banks are big and become bigger and stronger, they tend to fund the development and the prosperity of the nation, not the foreign ones,” he said on Tuesday, August 22.

The Bank of Ghana (BoG) withdrew the licences of the two banks recently and GCB Bank took over transfers of all their deposits and selected assets after a purchase agreement.

The accounts of the directors and managers have been frozen by the Central Bank following the commencement of a probe to investigate activities that led to the collapse of the banks.

Arrangements are being made to explore the option of the GCB Bank absorbing some of the workers of the defunct banks.

Dr Nduom, who is Chairman of Groupe Nduom which has dozens of companies including GN Bank in Ghana and Illinois-Service Federal Savings Bank (ISF Bank) in US, pointed out that: “It is sad to say, but I’m saying to everybody, don’t think that this happened all of a sudden.”

He explained, “We have all had the warning signs, and some have been able to deal with it. Others could not find the capital”.

The 2016 flag-bearer of the Progressive People’s Party (PPP) further urged other local banks to implement measures to see the growth of their banks to the benefit of the economy.

“… My advice to all of us in there is [for us] to strengthen our controls, loans and recovery practices and make sure indigenous banks are strong and thrive,” he advised during an interview with Nhyria Addo on Joy FM.