Business News of Saturday, 17 December 2016

Source: Seth Krampah

Odotobri Rural Bank opens Bantama branch

Odotobri Rural Bank Limited at Jacobu in the Amansie Central District of Ashanti Region has inaugurated its Bantama branch in Kumasi.

This comes to eleven the number of branches currently being operated by the Bank. The branches are, Jacobu, Obuasi, Bekwai, Asawasi, Krofuom and Maakro. The rest are, Roman Hill, Agric Nzema, Old Tafo, Ayigya and the newly opened Bantama branch. The Chairman of the Board of Directors, Mr. Ben Asamoah Boateng in an address expressed his profound appreciation to shareholders and customers of the Bank for their show of loyalty and said that has resulted in the current growth and tremendous performance of the Bank.

Underscoring the purpose of the occasion, the board chairman emphasized that the primary objective of the Bank is to help people to establish and grow their businesses, whether big or small which translates into helping people to improve upon their living conditions.

Mr Siaka Baaba Ahmed, CEO of the Bank, said to ensure effectiveness, the Bank continues to remain innovative in its product and service design and delivery. According to him, he is very much aware of the many other commercial banks and financial institutions in Bantama and anticipates a very tough competition but his competent management team gives him hope to easily penetrate the Bantama market and is very much ready for the challenges ahead.

He said in line with this, the Bank continues to pursue a strategic market segmentation plan to ensure that they could factor products and services to meet the immediate needs of the people within their operating territories. The CEO listed branch expansion, strengthening of their electronic banking products and services, branchless banking services, as part of the key projections of the Bank going into the future.

He said doing this would ensure customer satisfaction and convenient banking and also help the Bank to leverage its strength as a good lending bank. Mr. George K Annor, on behalf of the Managing Director of ARB Apex Bank Limited, noted that recent branch expansions of rural banks are a reflection of the massive improvement in the rural banking industry.

He recognized that the banking industry has become very competitive with a number of existing banks expanding and new ones also being established including micro finance firms in both urban and rural communities.

He said to survive this increasing competition; rural banks should endeavor to improve their customer service delivery. He maintained that this would contribute significantly to attract new customers while maintaining existing ones. To do this, he urged that banking personnel should be reoriented to embrace excellence in customer service as a culture and not as a tool for doing business. He further suggested that members of staff who excel in customer service delivery should be adequately rewarded to motivate others.

He also advised rural banks to improve on their physical infrastructure as one of the means to ensure attractiveness and convenience to existing and potential customers.

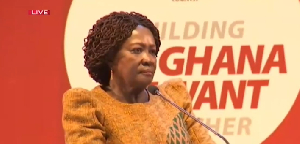

The CEO , Mr Siaka Ahmed Baaba being (middle) being assisted to cut the tape to officially open the branch