Business News of Monday, 31 August 2020

Source: ghanaiantimes.com.gh

BoG deserves commendation for paying depositors of collapsed banks

The Bank of Ghana (BoG) in 2019 completed a major clean-up of the banking sector, resulting in the revocation of the licences of nine banks.

The exercise, which commenced in 2017, led to the reduction in the number of banks in the country from 36 to 23.

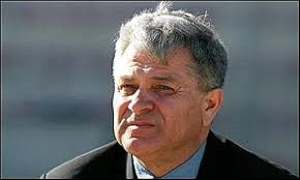

Governor of the BoG, Dr Ernest Addison, explained at the time that the central bank had “to take tough but necessary steps to clean up the banking sector and reposition it to support the economic growth and transformation agenda of Ghana”.

He said the country could now look forward to a strong, stable and liquid banking sector that could support the government’s economic transformation agenda.

Following the completion of the exercise, there was also the withdrawal of the licences of 23 insolvent savings and loans and finance house companies.

The BoG stated that the revocation of the licences had become necessary because the companies had remained insolvent even after a reasonable period within which the Central Bank engaged with them in the hope that they would be recapitalised by their shareholders to return them to solvency.

It is on this basis that the Ghanaian Times finds it gratifying to know that the government has completed the process of paying all depositors of the nine banks whose licences were revoked as well as making payment to 95 per cent of depositors of these collapsed Specialised Deposit Taking Institutions (SDIs).

It is a huge sigh of relief for customers that the exercise ended successfully without them losing their money.

We commend the BoG for its efforts in paying back the affected customers and urge it to make payments to the remaining five per cent depositors.

We, however, cannot ignore snippets of complaints from some depositors of savings and loans and microfinance companies that they were yet to go through the validation process required for payment.

At the same time, customers of the 53 Fund Management companies which had their licences revoked by the Security and Exchange Commission (SEC) are sounding similar cries to the government for their monies to be paid.

It is our hope that the BoG and the SEC will bring back smiles on the faces of all depositors by expediting the necessary actions to pave the way for all depositors to receive their money.

Meanwhile, we call on the government to ensure that all those found to be responsible for the collapse of the affected financial institutions are made to face the full rigours of the law.

Entertainment