- Home - Sports

- Soccer Portal

- Archived Sports News

- Sports Videos | TV

- Year In Review

- Sports Photos

- Sports Headlines

- Boxing

- Athletics

- Basketball

- Bodybuilding

- Cricket

- Golf

- Handball

- Hockey

- Martial Arts

- Tennis

- Volleyball

- Other Sports

Business News of Friday, 4 September 2020

Source: thebusiness24online.net

KIA reopening: Glimmer of hope for forex bureau operators as passengers jet in

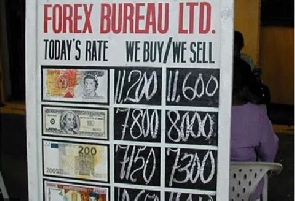

Forex Bureau operators are heaving a sigh of relief after commercial passenger flights touched the tarmac of the Kotoka International Airport (KIA) for the first time since March when Ghana closed her borders as part of measures to curb the spread of COVID-19.

The arrival of both evacuees and foreign nationals on Tuesday has evoked cautious optimism amongst forex traders expecting a rebound from a near-collapse experience caused by the pandemic.

The forex business in Ghana, which hinges on patronage from importers, expatriate businesses, the traveling public, and inbound tourists, suffered its worst forex turnover in decades as draconian restrictions on human movement were introduced to battle the virus.

“It’s foreigners and importers that largely buy and sell foreign currencies from us and since the restrictions on movement were implemented, we’ve not had people walking in to transact business with us. Business was not good before the pandemic but worsened during the period and we are yet to recover from the shock. We considered closing the business,” Daniel Addy Selby, Manager of Rahama Forex Bureau in Accra told Business24.

As passengers from across the world begin to fly in and the yuletide approaches, the forex traders anticipate an increase in demand and supply of foreign currencies by visiting tourists and importers stocking up to meet the usual increase in demand during the period.

“With the airport reopened, we expect the foreign nationals coming in for tourism and business to start transacting with us so that we can recover. Also, Christmas is around the corner so we are hoping that demand for the currencies will rise,” Mr. Selby said.

But as the pandemic lingers and the country’s borders remained partially closed, some analysts forecast activity on the forex bureau market to remain low till next year when hopefully, restrictions around the world would be largely relaxed.

“The reopening of Ghana’s airport will not make much impact in terms of the demand and supply of foreign currencies across the forex bureau market. The borders of some trading partners remain closed; health professionals have warned against leisure travels and economic activity is yet to return to pre-covid era.

Therefore, they may have to wait a bit longer for activity on their market to improve,” economist and currency analyst with Databank Research, Courage Martey told Business24.

The weak regulatory regime has resulted in scanty data about the forex bureau industry, with details such as forex turnover unavailable, making it impossible to analyse market trends. The Bank of Ghana has recently enforced some reforms in the industry but activity on the market remain largely undocumented.

Plight worsened by ‘black market’

The central bank’s directive to forex bureau operators to demand identification cards before engaging in forex trading drives one-time clients to the black market to transact business.

“The BoG directed us to request ID cards before buying or selling any currency. Then just in front of our shops are black market guys trading without asking for ID cards. Why will the customer waste time to give ID card when he or she can get sorted without all the bureaucracies,” a forex bureau operator who wants to remain anonymous told Business24.

Currency analyst Courage Martey attributed their ordeal to the regulatory failure on the side of the central bank, urging it to extend its regulations to the parallel market to curtail the disruptions caused by such players.

He added that: “the black market dealers cause a lot of disruptions on the market, setting exchange rates on their terms thereby undoing all the gains achieved through stringent supervision. The Bank of Ghana must do well to regulate their activity or clamp-on their operations.”