Business News of Wednesday, 3 May 2017

Source: thebftonline.com

Banker advocates US$200m capital for banks

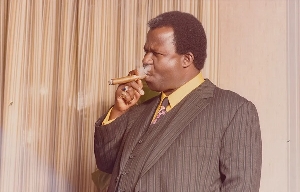

Frank Adu Jnr, Managing Director of CAL Bank, has proposed an increment in the current minimum capital requirement for universal banks from GH¢120million to US$200million, to create larger banks that can undertake big-ticket transactions.

This, according to him, would enable banks finance massive infrastructural developments such as airports, bridges, roads, ports and harbours.

“I think this economy need banks that should have a minimum of US$200million. Let us get real. Don’t you think that we need the financial muscle to do the business of this country? Do you think government should continue being responsible for the building of harbours and airports, interchanges and others?” he queried.

“With Heathrow expanding its runways, do you think it is the British government that is expanding the airport? Heathrow is raising its own money. Why shouldn’t we encourage and empower the private sector and the banks to take all these things away from government?”

To him, government must focus on the business of making it possible for private banks and businesses to develop this country. “We should have private sector banks leading the building of harbours, airports, bridges, runway for airports,” he added.

The Ghana Airports Company Limited (GACL), last year, had to look beyond the shores of Ghana for a US$250million loan to undertake the construction of a new terminal, T3, at the Kotoka International Airport (KIA).

African Development Bank (AfDB) and South African bank, ABSA, also provided an additional US$150million loan facility to GACL for the construction of the Ho and WA airports. This raised questions about the financial muscle of local banks to fund such large infrastructure project.

Currently pegged at GH¢120million, the amount of capital commercial banks have to hold has dropped in value as compared to the US dollar--from around US$60million in 2012 to under US$30million presently.

But the Central Bank has insisted it will go ahead with plans to raise the minimum capital requirement from the current GH¢120million set in 2012, to a figure, and on a date, it is yet to disclose.

Whilst opinions differ on how much is good enough as stated minimum capital for banks, both the central bank and industry players agree that the current figure is not adequate.

Mergers and acquisitions

Ghana is a nation of 26million inhabitants, with a Gross Domestic Product (GDP) of almost US$35billion, and a universal bank tally of 35.

South Africa is a nation of 55million inhabitants, with a GDP of close to US$400billion, but with a universal bank tally of less than 20. Still, Nigeria is a nation of almost 200million inhabitants, with a GDP in excess of US$500billion, but with a universal bank tally of less than 25.

This, Managing Director of Zenith Bank, Henry Oroh, believes does not augur well for the industry. “Raising the capital up by the central bank is to compel banks to come together in a way to achieve bigger banks…When you look at the size of Ghana’s economy with over thirty-three banks, we are over banked if you ask me, compared to bigger economies like Nigeria and South Africa which have much less number of banks,” Henry Oroh noted.

According to Mr. Oroh, the Central Bank has proposed an increment in the minimum capital from GH¢120million to GH¢260 million cedis.

Asked whether Cal Bank would merge with another institution to create the financial giants he thinks the economy should have, Mr. Adu said: “We have always been in the market looking for a bride. We haven’t found one yet but we are still looking.”