Business News of Friday, 4 September 2015

Source: GNA

‘Institute incubation seminars for unemployed’

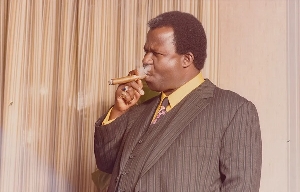

Dr Samuel Ankrah, the Chief Executive Officer of Africa Investment Group, has called on banks to institute incubation seminars for unemployed graduates who have the entrepreneurial spirit to enable them to start their businesses.

This, he said, would help to open up the economy to new and profitable ideas and ventures.

“With the ever growing pool of unemployed graduates, which stands at 700,000 at home and unemployed with about 70,000 coming out of tertiary institutions each year, the banking industry needs to examine the possibility of introducing incubation seminars for young graduates,” he said.

Addressing the 14th Ghana Banking Awards in Accra on the theme: “Identifying and rewarding excellence in the banking services proposition,” Dr Ankrah said such seminars would not only help the beneficiaries, but also give the banks more opportunity as agents of change.

Dr Ankrah, who is also an Investment Analyst, expressed concern about the investment of the stabilisation and heritage funds, totalling about $448M in foreign portfolios at a rate of 2 per cent and 2.5 per cent respectively at a time that the economy was in dire need of funds to stimulate businesses.

“Where is the justification when we are borrowing with conditions that are not necessarily in our sovereign interest and at a time when almost every major investments in our country is undertaken by non-Ghanaian firms for lack of capacity and capability with the most obvious excuse being that we do not have the funds,” he said.

He said an investment of over $400 million could provide over 20,000 affordable rental housing for nurses, doctors, civil and public servants, our security agencies and the general populace at large.

He said with an estimated rental income of only $100 per month, that could rake back into the stabilization and heritage funds a whopping $24M annually and more to establish a sustainable cash flow for the managers of our economy and the national budget.

He said such an action could be repeated in other sectors of the economy without the need for International Monetary Fund’s assistance.

He said it would take dynamism, creativity, innovation and result-oriented domestic banking and finance industry, and a team effort to stimulate the economy from the current downturn.

Dr Ankrah urged the banking sector to evaluate its contribution to tillage, storage, value-added processing and export in the agricultural sector as well as support for research and development in the timber and mining sectors considering the fact that the country had relied for almost all her lifetime on these commodities.

He said although the youth, including graduates were eager to get into farming, banks were reluctant to lend the needed capital to start the farms as they keep asking for collateral.

He wondered why banking in Ghana had over the years shied away from pioneering an adventurous spirit that built the so-called ‘tiger economies’ that many of us still admire.

“It could be that we have not invested enough confidence in ourselves to the extent that a number of us still seek offshore approval for even unpretentious investment proposals from indigenous clients,” he said.

Dr Ankrah said with a proper screening and diligent recovery schedule, a consortium of banks could grab the initiative from Government and set it up more efficiently as an adjunct to their interest in manpower development.

He said although there were a good number of finance houses doing great things by financing business start-ups, there are also far too many stories of loan applications being turned down purely for lack of track record or experience even though most of these business proposals are viable.