Business News of Friday, 26 May 2017

Source: thebftonline.com

Banks must respond to policy rate cut - GCCI

The Ghana Chamber of Commerce and Industry (GCCI) has called on banks to reduce their lending rates to reflect the recent cut in the Bank of Ghana’s policy rate.

The Monetary Policy Committee (MPC) of the Bank of Ghana, on Monday, reduced its policy rate by 100 basis points to bring the policy rate down to 22.5 percent.

The GCCI, which an association of business operators, firms and industries with interests spanning all sectors of private enterprise in Ghana, are keen to see that banks respond accordingly.

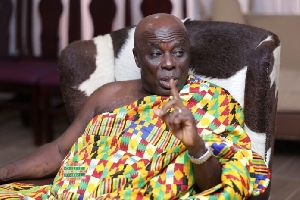

In an interview with the B&FT, Nana Appiagyei Dankawoso I, President of the Ghana Chamber of Commerce and Industry (GCCI), said: “It is very immediate that the banks also respond to the policy rate cut. You see we are calling for industrialisation and reduction of unemployment. We are calling for an improved economy. And all of these we cannot do it without the support of the banks. But one of the biggest challenge we have in Ghana now is cost of credit.”

He added that the falling of Treasury Bill rates should see more funds channelled into productive sectors of the economy. “As you can see, T-Bill rates are going down and that means a lot of people will like to rather invest in more productive ventures, and that will create more jobs and improve the livelihoods of people too.

So, we welcome the move by the Bank of Ghana to further cut the policy rate, even though the margin is small, but we hope the banks too will respond in like manner for the cost of credit to come down to help businesses,” he added.

Samuel Baba Adongo, Country Director of Technoserve Ghana, a company which supports SMEs, said the high cost of capital in the economy is really impeding the growth of SMEs, as some have collapsed because they defaulted in the repayment of their loans.

“The cost of financing has become so prohibitive that it doesn’t just only deter businesses, but it increases their cost of operations. In many instances, because they are desperately looking for capital, they take those prohibitive interest rates, and sooner or later they default and their businesses end up collapsing. So, cost of capital has been a major problem for SMEs,” Mr. Adongo said.

He urged banks to “respond to the policy rate cut in the same direction by ensuring that interest rates are lowered.”

“The last time the policy rate was cut I realised one or two banks made attempts to reduce their base rates, but they are still high, and it is a problem for industry and entrepreneurs looking for finance to augment their working capital. So, banks and the other financial institutions should respond by also reducing their interest rates,” he said.

Others, such as Dr. Raziel Obeng-Okon, an investment banker and lecturer in Public Accounting at the Ghana Institute of Management Public Administration (GIMPA), believes that the Bank of Ghana could have reduced the policy rate by some 200 basis points.

“Even though the Monetary Policy Committee members have done well by reducing the MPR by 100 basis points to 22.5%, it could have come down by up to 200 basis points. Given the growth prospects and the emergence of strong economic fundamentals vis-à-vis the month by month improvement and stability in the goods and services market, foreign exchange market, and the money market.

The MPR could have been reduced by 150 to 200 basis point to either 22.0% or 21.5%. The MPR must establish a certain equilibrium not only in the goods and services market, but the forex market and financial services market. Currently, the gap between the Treasury bill rates and the MPR is an anomaly which has to be corrected,” he said.