- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

Business News of Sunday, 15 July 2018

Source: thebftonline.com

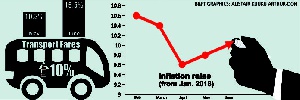

Transport fares push inflation to double-digits, hits 10% in June

The 10 percent increment of transport fares in May 2018 has increased the general price levels of goods and services in June by 10 percent, making it the first time in three months that inflation figures hit double-digits, Ghana Statistical Service (GSS) data have shown.

“The general cause of the rise in inflation rate is due to the rise in the non-food inflation rate. We observed that the inflation rate for non-food went up in June 2018, from a figure of 10.9 percent to 11.2percent.

“The inflation rate for food, within the same period, went down from 7.6 percent in May to 7.3 percent in June.

“Specifically, within the non-food group we can zero-in on transport. It went up from 10.3 percent in May to 15.5 percent in June. There was an increase in transport fares by 10 percent in the month of May, and that is what we observed to be driving the inflation rate upward,” Acting Government Statistician Mr. Baah Wadieh said at the figures’ release in Accra yesterday.

Drivers of the non-food group include clothing and footwear, which recorded an inflation rate of 16.1 Percent; transport 15.5 percent; recreation and culture 13.8 percent; furnishing and household equipment 13.3 percent; and miscellaneous 12.7 percent.

The food and non-alcoholic beverage group recorded a year-on-year inflation rate of 7.3 percent, 0.3 percentage points higher than the rate recorded in May. Drivers of this group are coffee, tea and cocoa, which recorded 10.3 percent; fruits 9.6 percent; meat and meat products 8.7 percent; mineral water, soft drinks 8.4 percent; vegetables 8.3 percent; and food products 7.7 percent. This means that six subgroups recorded rates higher than the basket’s average of 7.3 percent.

Inflation for imported items also recorded 11.8 percent – a drop from the 12.4 percent recorded last month.

This rate was 2.6 percentage points higher than that of locally produced items – which recorded 9.2 percent.

At the regional level, four regions—Upper West, Brong Ahafo, Western and Ashanti—all recorded rates higher than the national average.

Upper West recorded 11.9 percent, followed by Brong Ahafo with 10.9; whereas the Upper East Region recorded the lowest rate at 8.1 percent.

Will BoG further cut policy rate?

The Bank of Ghana in April this year decreased the policy rate for the sixth time by 100 basis points to 17 percent, following the drop of inflation to 9.6 percent in April. The bank cited favourable inflation conditions as the main reason for its decision.

The Bank said: “Both headline and core inflation have broadly trended downward, indicating easing underlying inflation pressures. Additionally, weighted inflation expectations across the sectors have continued to decline. Headline inflation trended within the medium-term target of 8±2 percent, and the forecast points to sustained disinflation over the horizon, barring unanticipated shocks.

“Under the circumstances, the Committee noted that the risks to the inflation outlook are subdued on the forecast horizon. While global and domestic developments do not yet pose a threat to inflation in the near-term, recent changes in global financing conditions and their impact on emerging market asset classes require some vigilance.

“Consequently, the Committee decided to reduce the monetary policy rate by 100 basis points to 17percent. The Committee, however, stands ready to take the appropriate policy measures to address any potential threats to the disinflation path,” Ernest Addison, Bank of Ghana Governor, said in April.

However, with inflation hitting 10 percent this month, it is unclear if the central bank will reduce the policy rate for the seventh time – or, at worst, maintain it at 17 percent.